- InsiderTrackers

- Posts

- Insider Trackers: November 10-14, 2025

Insider Trackers: November 10-14, 2025

Your weekly read on where corporate insiders are moving their own money.

The second week of November delivered a stark reminder that market holidays aren't the only thing that can slow the trading floor. With Veterans Day shuttering markets on Monday and Tuesday, insider activity dropped to a whisper—just 13 total transactions across three active days. But what lacked in volume, it made up for in conviction.

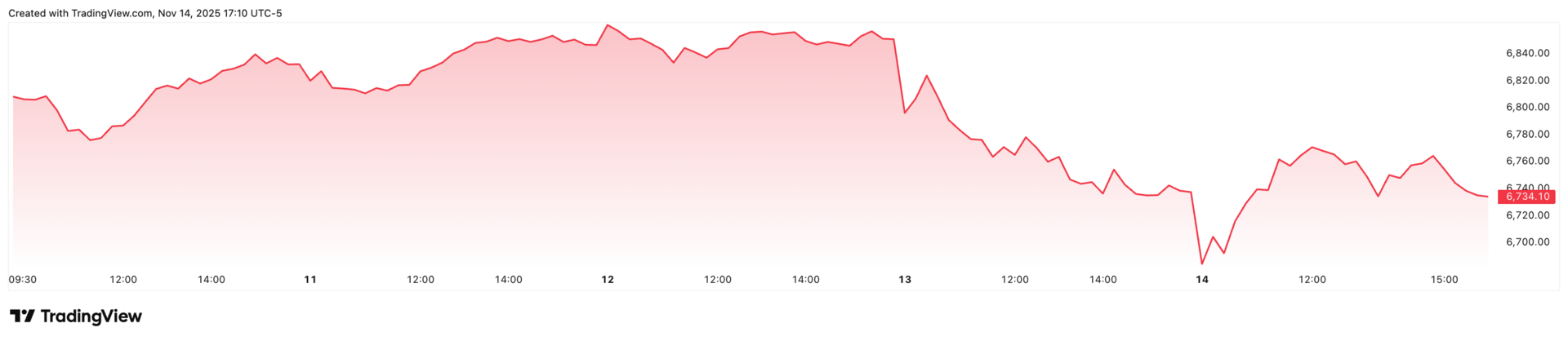

The S&P 500 consolidated around the 6,800-6,850 level during the second week of November, with the Dow Jones breaking above 48,000 for the first time.

Against a backdrop of the Dow Jones Industrial Average punching through 48,000 for the first time and the S&P 500 hovering near 6,850, insiders sent an unusually bullish signal: $5.66 million in open-market cash purchases versus just $1.43 million in sales. That's a 4:1 buy-to-sell ratio on dollar volume—a rarity in any market environment, but especially striking when the broader market trades at forward P/E ratios north of 22x. When insiders are reaching into their own pockets at these valuations, it demands attention.

💰 Top Insider Trades

Roper Technologies (ROP) — The Week's Clear Winner

The industrial software conglomerate dominated the week's activity with a coordinated buying spree that screamed confidence.

Laurence Neil Hunn, President and CEO, executed two open-market purchases on November 12th:

8,000 shares at $452.40 = $3.62M

2,000 shares at $451.58 = $903K

Total: $4.52M in personal capital deployed

Amy Woods Brinkley, Director, followed suit on the same day:

1,200 shares at $450.71 = $541K

Combined, two insiders poured $5.06 million into ROP stock at prices around $450-452/share—well below the stock's 52-week high of $595 but representing a massive vote of confidence in the company's trajectory. Roper recently reported Q3 results showing 14% revenue growth year-over-year and maintains a 40% adjusted EBITDA margin. The company's focus on vertical software acquisitions and its M&A firepower (over $5 billion available) positions it as a serial compounder. CEO Hunn's willingness to commit nearly $4.5M of personal wealth suggests management sees significant runway ahead, particularly as the stock trades 25% below its yearly highs.

CVB Financial Corp (CVBF) — Regional Bank Director Goes All-In

George A. Borba Jr., Director, made the week's second-largest open-market purchase:

27,094 shares at $18.45 = $500K

Post-transaction ownership: 745,782 shares

This half-million-dollar bet on a California regional bank is noteworthy for several reasons. CVBF currently yields 4.27% and trades at a P/E of just 12.6x—significantly cheaper than the broader market. The bank recently reported its 194th consecutive quarter of profitability and maintains strong credit metrics with a return on average assets of 1.35%. Borba's purchase suggests confidence that regional banks will benefit as Fed rate cuts continue to materialize and funding costs stabilize. With analysts projecting 30% upside to their average price target of $24.33, this looks like a value play with income.

RB Global (RBA) — Fresh Director Conviction

Deborah Stein, Director, purchased her inaugural position:

1,000 shares at $101.26 = $101K

This was a first-time buy, establishing her ownership stake

RB Global operates in specialty business services within the industrials sector. While smaller in dollar terms, a director making an initial purchase at $101/share demonstrates belief in the company's long-term value proposition.

Incannex Healthcare (IXHL) — Massive Grants, Zero Signal

The week's largest transaction by share count came from Incannex Healthcare, where six insiders received a combined 39.8 million shares in awards/grants on November 14th. Key recipients included:

Joel Latham (CEO): 22.6M shares

Troy Valentine (Director): 11.3M shares

Various other directors: 1.7M-1.7M shares each

Important distinction: These were compensation grants at $0 transaction value, NOT open-market purchases. While the share count is staggering, this represents standard executive compensation for the drug manufacturer—no cash exchanged hands, and no signal can be derived about management's views on current valuation.

This Week's Sales

BXP, Inc. (BXP) — REIT Office

John J. Stroman, EVP: Sold 16,838 shares at $72.17 = $1.22M

Sold entire position (0 shares remaining)

Likely compensation-related liquidity

Bankwell Financial Group (BWFG)

Christine Chivily, EVP & Chief Credit Officer: Sold 2,553 shares at $45.52 = $116K

Standard executive diversification

Sylvamo Corporation (SLVM)

Kevin W. Ferguson, VP/Controller: Sold 2,000 shares at $48.70 = $97K

Minor position adjustment

None of these sales appear particularly concerning—they're small relative to the companies' market caps and consistent with normal executive portfolio management.

🌊 Sector Themes

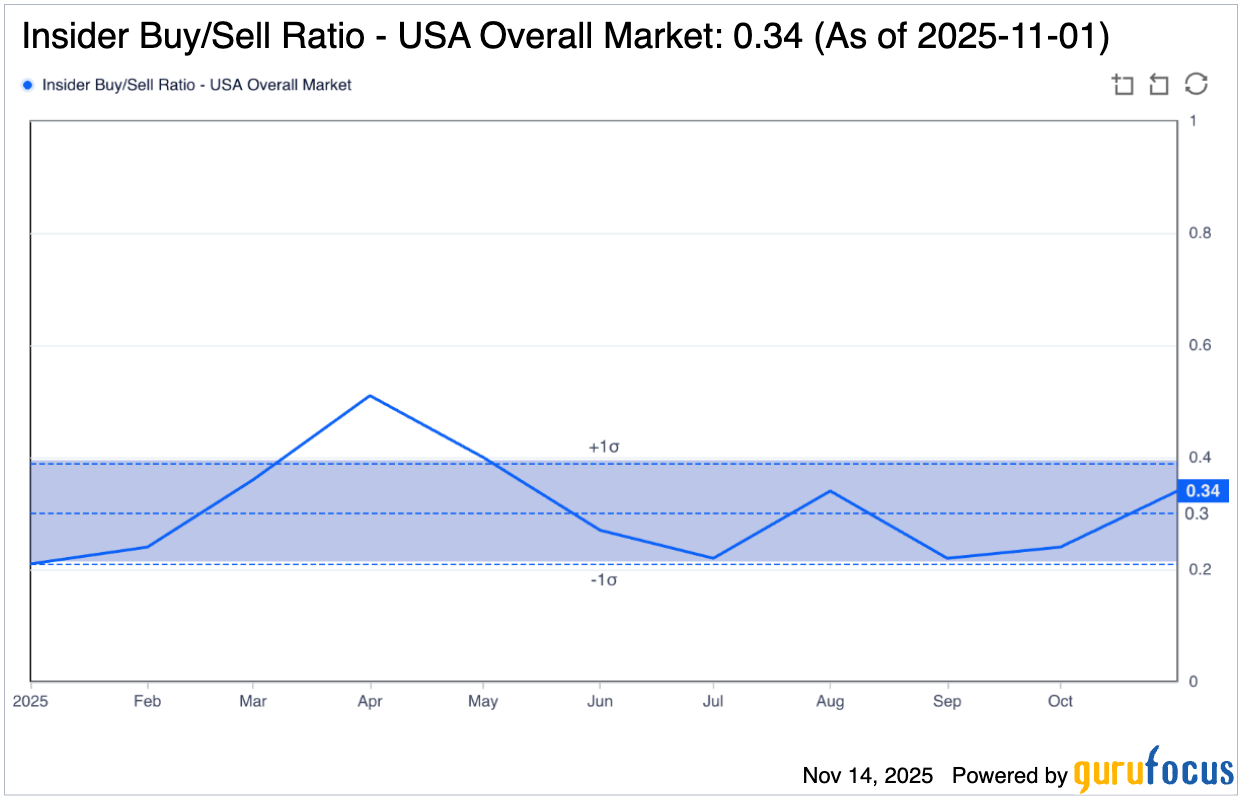

The U.S. market-wide insider buy/sell ratio has historically hovered around 0.22-0.34, with this week's concentrated buying in industrials and financials standing out against broader market trends.

Industrials: The Conviction Center

Four of the week's seven actual trades (excluding grants) came from the industrials sector, and all four were purchases. ROP alone accounted for $5.06M in buying, while RBA added another $101K. This cluster buying in industrial software and business services suggests insiders see value in companies with recurring revenue models and mission-critical software solutions. With tariff uncertainty lingering and a potential economic slowdown on the horizon, these defensive-growth hybrids may be positioning as relative safe havens.

Financial Services: Selective Bank Buying

Regional banks showed split activity—one director bought $500K of CVBF while another executive sold $116K of BWFG. The net signal leans bullish, particularly given the size disparity. As the Fed navigates its rate-cutting cycle (100 basis points cut since September 2024), regional banks are expected to see funding costs stabilize while loan demand gradually recovers. CVBF's director purchase aligns with this thesis. The sector trades at forward P/E ratios of 10-12x and price-to-book values near 1.0x—historically attractive levels.

Healthcare: All Noise, No Signal

Six transactions, 39.8 million shares, $0 in cash deployed. Incannex Healthcare's grant-heavy week offers nothing for signal-seekers. When insiders receive shares as compensation, it tells us about retention strategy, not market conviction. Skip this sector this week.

Real Estate: The Exit

BXP's EVP sold his entire position—$1.22M worth of REIT-Office exposure. While office REITs remain challenged by remote work trends, a single executive liquidation isn't necessarily bearish. It could reflect personal financial planning or portfolio rebalancing. Still, the absence of any buying in real estate is notable.

The Missing Cluster: Technology

Perhaps most striking is what didn't happen. Zero tech insider activity during a week when the Nasdaq traded near 23,400 and mega-cap tech companies hit all-time highs. When insiders aren't buying technology at these levels, it may signal that even those with inside knowledge see current valuations as full. The AI trade continues to dominate market returns, but corporate insiders appear content to ride existing positions rather than add new exposure.

Investor Takeaways

1. Open-market buying at elevated valuations = high signal. When a CEO commits $4.5M of personal capital to buy stock at $450/share (not exercising options, not receiving grants—actual cash purchases), it's one of the strongest conviction signals available to outside investors. Roper Technologies' coordinated buying deserves serious attention.

2. Regional bank insiders are positioning for the rate-cut cycle. CVBF's $500K director purchase aligns with the thesis that 2025 could be a recovery year for regional banks as funding costs normalize and loan demand recovers. These stocks trade at historically cheap valuations with attractive dividend yields.

3. Volume matters less than conviction. Thirteen transactions in a holiday-shortened week may seem insignificant, but the 4:1 buy-to-sell ratio by dollar value is remarkable. Insiders are being selective, but when they buy, they're buying with size.

4. Grants ≠ purchases. Nearly 40 million shares changed hands at Incannex, but none of it involved cash. Always differentiate between compensation events (neutral) and open-market conviction (high signal).

5. The tech silence is deafening. With AI stocks at all-time highs and forward multiples stretched, the absence of tech insider buying suggests the smart money may be letting momentum carry existing positions rather than adding risk at current levels.

👀 Watchlist

ROP (Roper Technologies) — The $5M+ cluster buy from CEO and director at ~$450 makes this the week's highest-conviction pick. Trading 25% below 52-week highs with 14% revenue growth and 40% EBITDA margins. Monitor for continued insider accumulation or any sign of a new acquisition announcement.

CVBF (CVB Financial Corp) — A $500K director purchase in a 12x P/E regional bank yielding 4.3%. If you believe in the regional bank recovery thesis as rates normalize, this is insider-validated entry point. Watch for Q4 loan growth commentary.

KRE (SPDR Regional Bank ETF) — While not a direct insider play, the concentrated buying in regional financials suggests broader sector tailwinds. The ETF is up 36% over the past year but still trades below pre-2023 crisis levels.

RBA (RB Global) — Director's first-time $101K purchase signals long-term confidence. Industrial services company with recurring revenue characteristics. Worth deeper due diligence.

BXP (BXP, Inc.) — On the negative watchlist. EVP liquidated entire position in office REIT. May warrant review of existing office real estate exposure given insider exit.

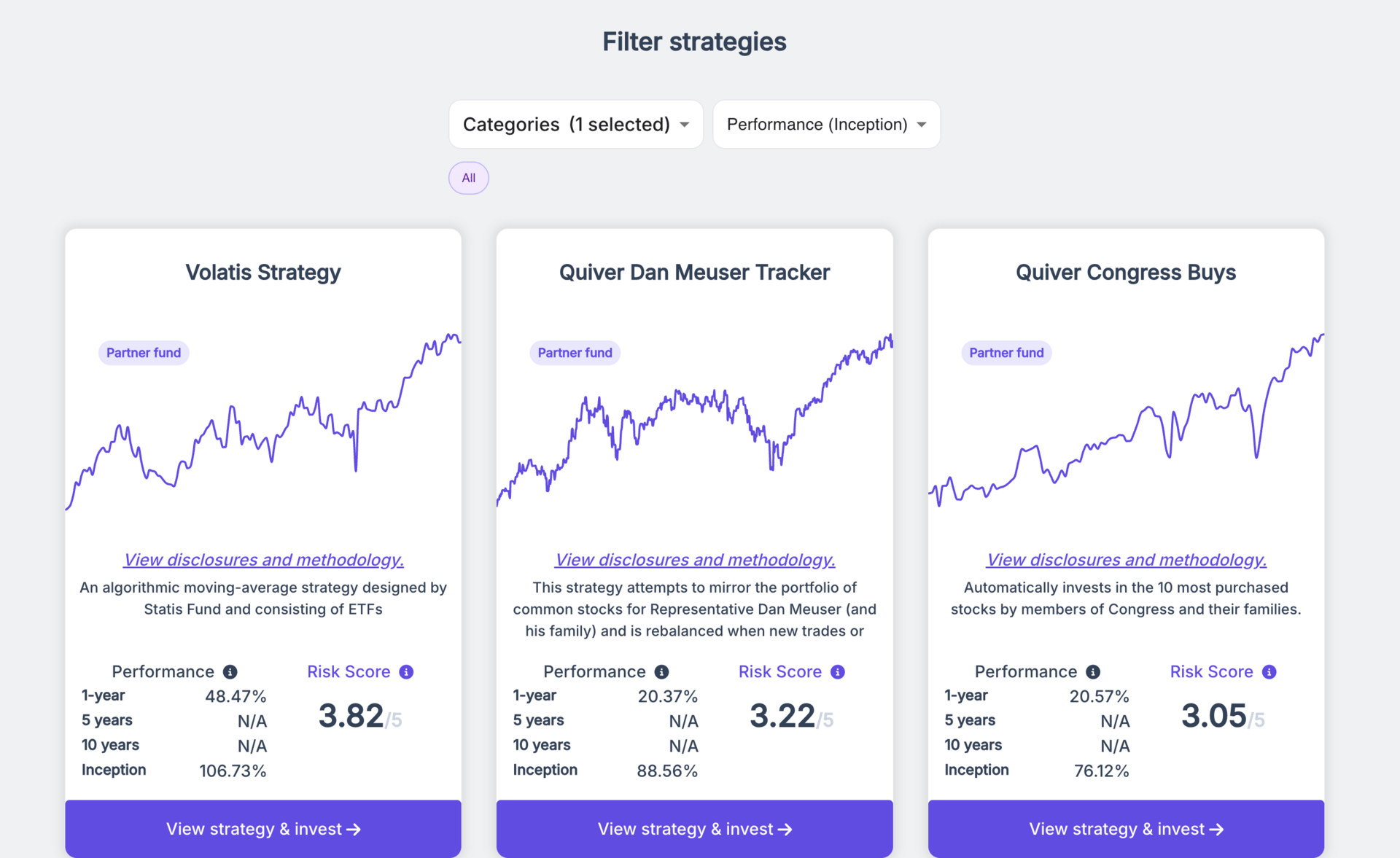

📈 Looking to copy-trade or invest in quantitative portfolios?

Quantbase offers both rules-based quant strategies and curated copy-trading strategies, including portfolios built on insider-trading signals. Everything runs automatically, letting you follow systematic models without the emotional noise.

👋 Closing Notes

This week's message from corporate insiders was clear despite low volume: conviction trumps caution. In a market environment where the S&P 500 trades at 22x+ forward earnings and the Dow breaks 48,000 for the first time, most rational actors would be taking chips off the table. Instead, we saw a CEO deploy $4.5 million into his company's stock and a bank director commit half a million to his regional lender.

The pattern suggests that insiders with deep company knowledge see value in specific segments—industrial software with recurring revenue and defensive characteristics, and regional banks poised to benefit from Fed policy normalization. Technology's silence, meanwhile, hints that the AI trade may be fully priced at current levels.

Next week brings fresh data points as earnings season winds down and the market digests the government shutdown resolution. Watch for whether this week's bullish signals extend or whether holiday-thinned markets produced an anomaly.

Until next Friday, stay sharp and follow the smart money—but only when it's their own cash on the line.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.