- InsiderTrackers

- Posts

- Insider Trackers: November 17-21, 2025

Insider Trackers: November 17-21, 2025

Your weekly read on where corporate insiders are moving their own money.

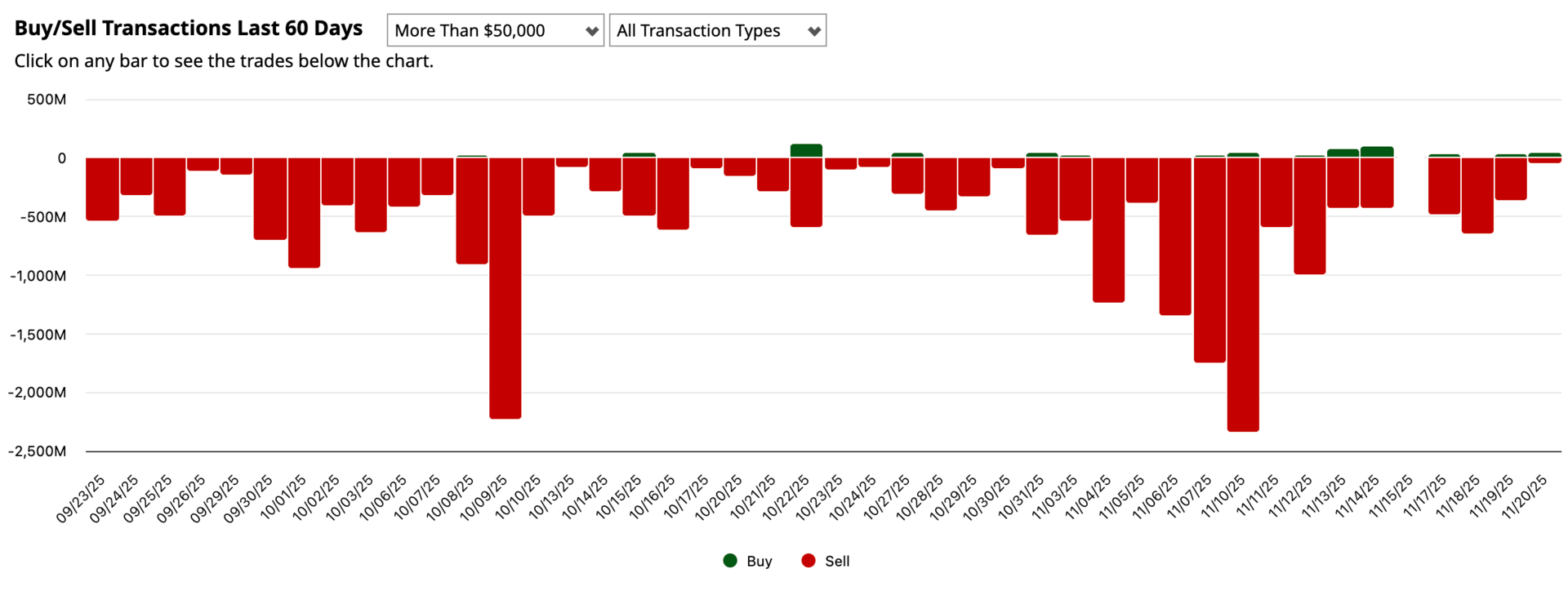

Markets entered a peculiar lull this week, and insider activity reflected it with striking clarity. In a week that spanned five trading days, only two insider transactions crossed the SEC filing wires—both sales, both on Tuesday, and both telling a story of executive liquidity moves rather than conviction signals. When insiders go quiet, it's worth asking why. Is it blackout season ahead of earnings? Regulatory caution? Or simply a collective pause as markets digest recent moves? Whatever the cause, this week's near-total silence stands in sharp contrast to typical weekly volumes that often see dozens of transactions. The absence of activity is itself a data point worth examining.

What we did see: a uranium producer director trimming a position, and a fintech executive executing a routine sale. Neither transaction carried the weight of open-market conviction buying. No insiders stepped up with their own cash to buy shares. No clustering of activity around specific sectors or themes. Just two isolated exits, separated by industries, separated by motivations, unified only by their lack of bullish signal.

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

💰 TOP INSIDER TRADES

With only two transactions to analyze, here's what moved:

Energy Fuels Inc. (UUUU)

Dennis Lyle Higgs, a director at this uranium-focused energy company, sold 15,000 shares at $15.26 per share on November 18, generating $228,900. This was a straightforward sale that reduced his holdings but still left him with a substantial 192,964 shares. The transaction appears to be a standard liquidity event—a director monetizing a portion of holdings after the stock has traded in a relatively stable range. With uranium markets showing mixed signals between supply constraints and demand uncertainty, this doesn't read as a bearish conviction play. Instead, it looks like garden-variety portfolio management. Higgs maintains a meaningful stake, which matters more than the exit itself. Still, it's worth noting that no insider at UUUU stepped up to buy during this period, even as uranium sentiment remains a topic of debate among energy investors.

Broadridge Financial Solutions, Inc. (BR)

Christopher John Perry, serving as President, sold 3,984 shares at $226 per share on November 18, totaling just over $900,000. This sale represents a much larger dollar value despite fewer shares, reflecting Broadridge's position as a premium-priced fintech infrastructure play. Perry retained 44,828 shares after the transaction, maintaining significant skin in the game. Broadridge has been a steady performer in the financial technology space, providing critical back-office infrastructure to the securities industry. This sale likely represents routine compensation-related liquidity or tax planning rather than a shift in outlook. The timing—mid-November, outside of typical earnings blackout windows—suggests personal financial management rather than information-driven selling.

Both transactions share a common thread: they're liquidity events, not conviction signals. Neither represents the kind of open-market buying that turns heads or suggests insiders see dramatic upside ahead. They're exits, plain and simple, and in isolation they tell us very little about forward expectations.

🌊 SECTOR THEMES

Energy - The Lonely Uranium Exit

The only energy sector transaction this week came from UUUU, where a single director reduced holdings. There's no wave of selling, no cluster of insiders heading for the exits, and notably—no buying. Uranium has been a volatile story over the past two years, swinging between supply deficit narratives and demand growth skepticism. This single sale doesn't confirm a sector trend; it barely registers as a whisper. What's more telling is the absence of coordinated activity. In sectors where insiders have strong conviction, you typically see multiple insiders acting within tight windows. That's not happening here.

Technology - Solo Fintech Sale

Broadridge's executive sale stands alone in the technology sector this week. Financial technology has been a resilient pocket of the market, with infrastructure plays like BR delivering predictable revenue streams tied to transaction volumes and regulatory compliance needs. Perry's sale doesn't signal sector weakness—it's a one-off event with no supporting cast of additional sellers or buyers. The broader technology sector saw no other insider activity in our dataset this week, making it impossible to draw trend conclusions.

The Missing Cluster

Here's what didn't happen: no healthcare insiders filed transactions. No consumer discretionary moves. No industrial or financial sector activity beyond Broadridge. No materials, real estate, utilities, or communications activity. Most importantly, no open-market buying anywhere. When insider buying goes silent across the entire market, it's worth considering whether we're in a seasonal lull (Thanksgiving week approaching), a regulatory blackout period for many companies, or simply a week where personal timing and market conditions didn't align for insiders to act. The absence of buying isn't necessarily bearish—it's just quiet.

💡 INVESTOR TAKEAWAYS

Limited signal, limited noise. With only two sales and zero buys, this week offers almost no directional information about insider sentiment. Both transactions appear to be routine liquidity events rather than information-driven decisions.

Silence isn't always bearish. The absence of insider buying doesn't automatically signal trouble. Blackout periods, personal timing constraints, and market conditions all influence when insiders transact. A quiet week is often just that—quiet.

Watch for the return of activity. When insider filing volumes return to normal levels, that's when patterns become meaningful again. A single week of low volume tells us nothing about the weeks ahead. Stay alert for clusters of buying or coordinated selling when activity resumes.

👀 WATCHLIST

UUUU (Energy Fuels) - Continue monitoring whether other insiders follow Higgs' lead with additional sales, or whether buying emerges if uranium fundamentals strengthen. A single sale doesn't make a trend, but the next few filings will be telling.

BR (Broadridge) - Track whether Perry's sale was an isolated event or the start of a pattern. Broadridge has been a steady performer; any cluster of insider selling would be worth noting given the company's reliable track record.

Broader market patterns - More important than any individual ticker this week is watching for when filing activity returns to normal volumes. The next week or two should reveal whether this was an anomaly or the start of a sustained quiet period

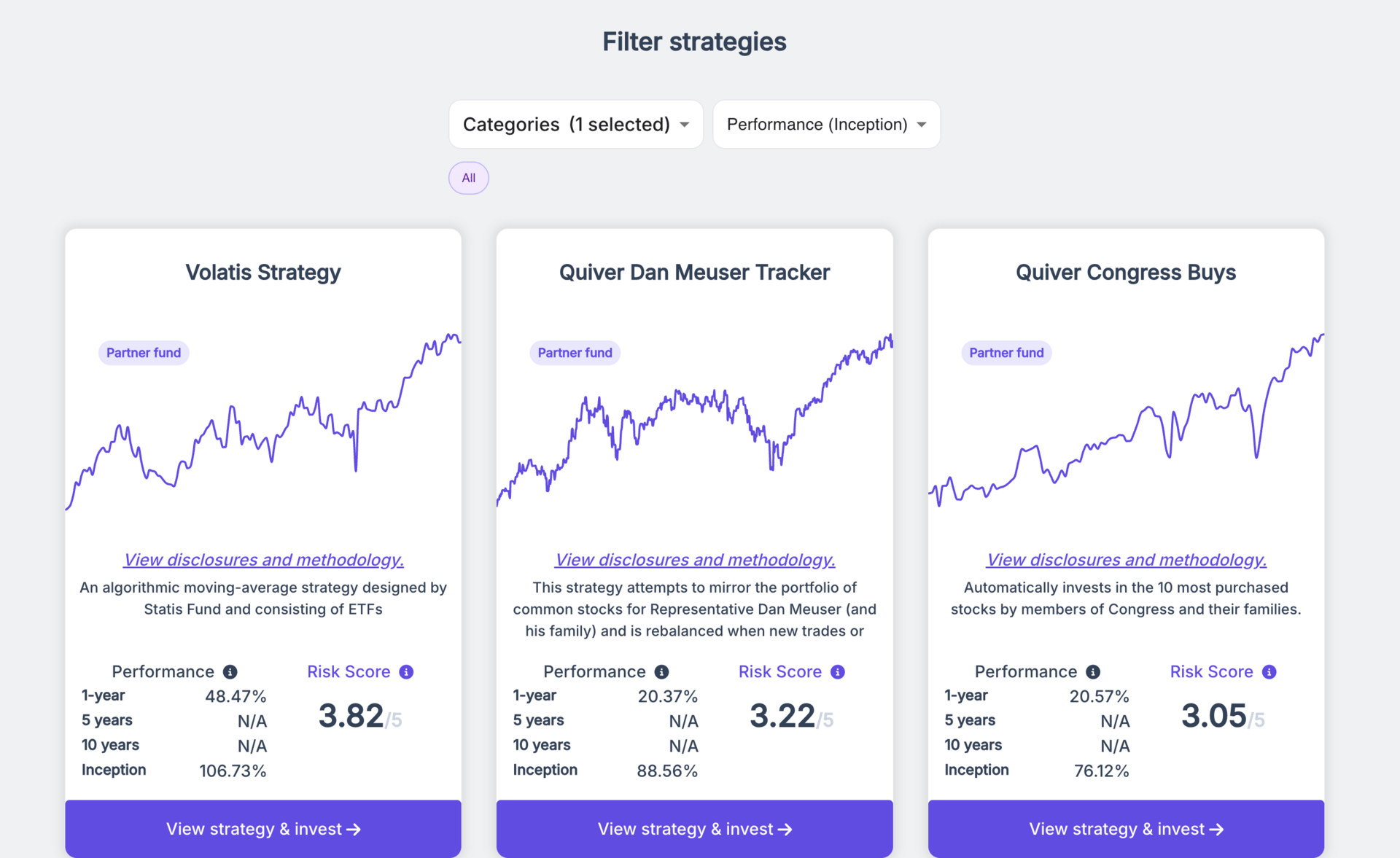

📈 Looking to copy-trade or invest in quantitative portfolios?

Quantbase offers both rules-based quant strategies and curated copy-trading strategies, including portfolios built on insider-trading signals. Everything runs automatically, letting you follow systematic models without the emotional noise.

👋 Closing Notes

Sometimes the story is in what didn't happen. This week's near-total absence of insider activity is unusual but not unheard of—particularly as we approach holiday periods and year-end planning. Neither of the two sales we saw carried the weight of conviction-based decisions. No insiders deployed their own capital to buy shares. No patterns emerged. No sectors showed coordinated behavior.

For investors, this week is a reminder that insider data is most valuable when you have volume and context. Two data points don't make a trend. Next week's filings will be far more instructive as we see whether activity returns to normal or whether this quiet pattern persists. Until then, the message is simple: insiders are sitting still, and sometimes that's the most honest signal of all.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.