- InsiderTrackers

- Posts

- Insider Trackers: November 24-28, 2025

Insider Trackers: November 24-28, 2025

Your weekly read on where corporate insiders are moving their own money.

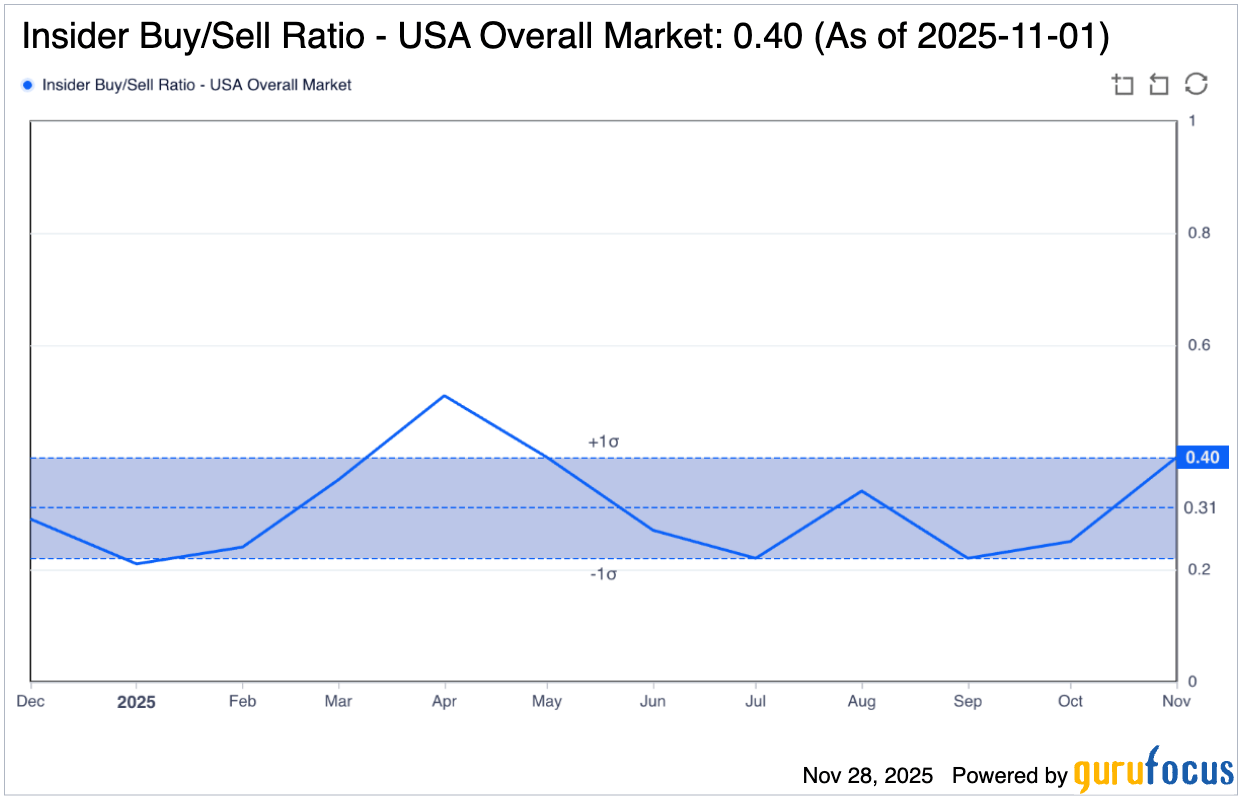

The week before Thanksgiving typically signals a slowdown in corporate activity, and this year delivered exactly that—with a twist. Just 15 insider transactions crossed the wire across ten companies, but the quality of those signals tells a more interesting story than the volume. While the market digested a shortened trading week and prepared for the holiday, corporate insiders sent a clear message: silence speaks louder than words.

This Week's Signal:

Only 2 open-market purchases against $3.6M in sales

7 compensation grants with zero conviction buying

The standout: Carrier Global CEO deploying $1M+ of personal capital

Energy infrastructure CEO quietly adds to position

Tech executives collect massive grants but won't buy shares

The standout move came from Carrier Global's CEO David Gitlin, who deployed over $1 million of his own capital just as HVAC and building automation stocks face questions about construction cycles.

Meanwhile, energy infrastructure plays quietly while tech executives cash in routine stock compensation. This wasn't a week of panic or euphoria—it was a week of watching who's willing to put cash to work when no one else is paying attention.

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

💰 Top Insider Trades

Carrier Global Corporation (CARR) – The Week's Only Seven-Figure Buy

Transaction Details:

Insider: David Gitlin, Chairman & CEO

Action: Open-market purchase of 19,300 shares at $52.62

Total Investment: $1,015,572

Holdings After: 534,474 shares

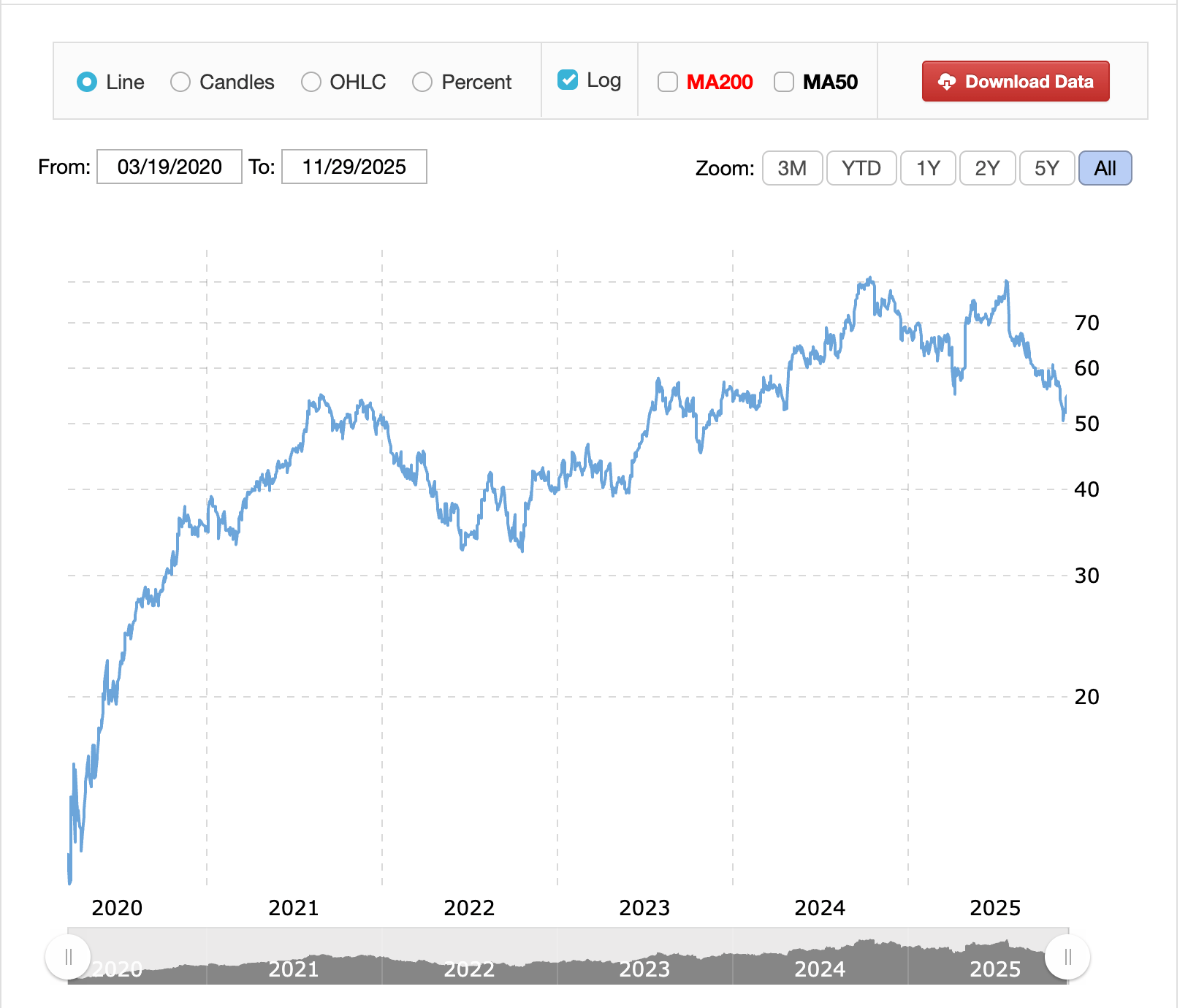

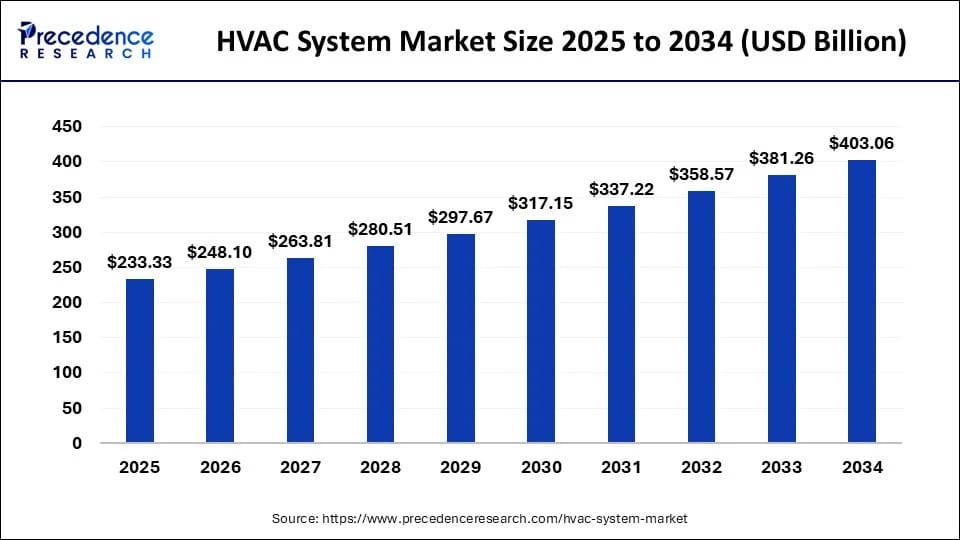

The HVAC and building automation sector faces real headwinds entering 2025. The global HVAC market is projected to grow at 6.8% CAGR through 2033, but commercial construction activity remains mixed. New construction deliveries are expected to decline, interest rates continue pressuring affordability, and the commercial market faces flat conditions.

Yet Gitlin chose this exact moment to deploy over $1 million of personal capital. This wasn't a token purchase—it represents genuine conviction when institutional attention wanes and holiday liquidity dries up. The timing amplifies the signal: buying when no one else is paying attention often indicates insider confidence divorced from public relations concerns.

HVAC Market Context:

Residential HVAC market growing 8.1% annually (2025-2029)

Commercial construction expected to hit $203.5B by 2029

Rising demand for energy-efficient systems offsetting volume pressures

Data center cooling needs creating new growth avenues

UWM Holdings Corporation (UWMC) – Routine Selling by Controlling Shareholder

Transaction Details:

Insider: Mat Ishbia, CEO & 10% Owner

Action: Sale of 437,073 shares at $5.85

Proceeds: $2,556,877

Holdings After: 3.05M shares

While this marks the week's largest sale by dollar volume, perspective matters. Ishbia retains massive ownership after the transaction, and sales by 10% owners with enormous positions typically represent routine liquidity management rather than bearish signals. United Wholesale Mortgage operates in challenging mortgage origination waters where volume remains subdued despite rate volatility. The notable absence: zero insider buying across the entire financial services sector this week.

Mueller Industries (MLI) – Director Selling Industrial Metals Play

Transaction Details:

Insider: Scott Jay Goldman, Director

Action: Sale of 4,234 shares at $108.64

Proceeds: $459,964

Holdings After: 41,745 shares

Mueller manufactures copper tube, brass and bronze products, and aluminum components—all directly exposed to construction, HVAC, and industrial demand. The sale came during a quiet week for industrials insiders, with no offsetting purchases to balance the signal. Single director sales rarely move investment theses, but the one-way flow of selling without any bullish counterbalancing in the industrial sector warrants notice.

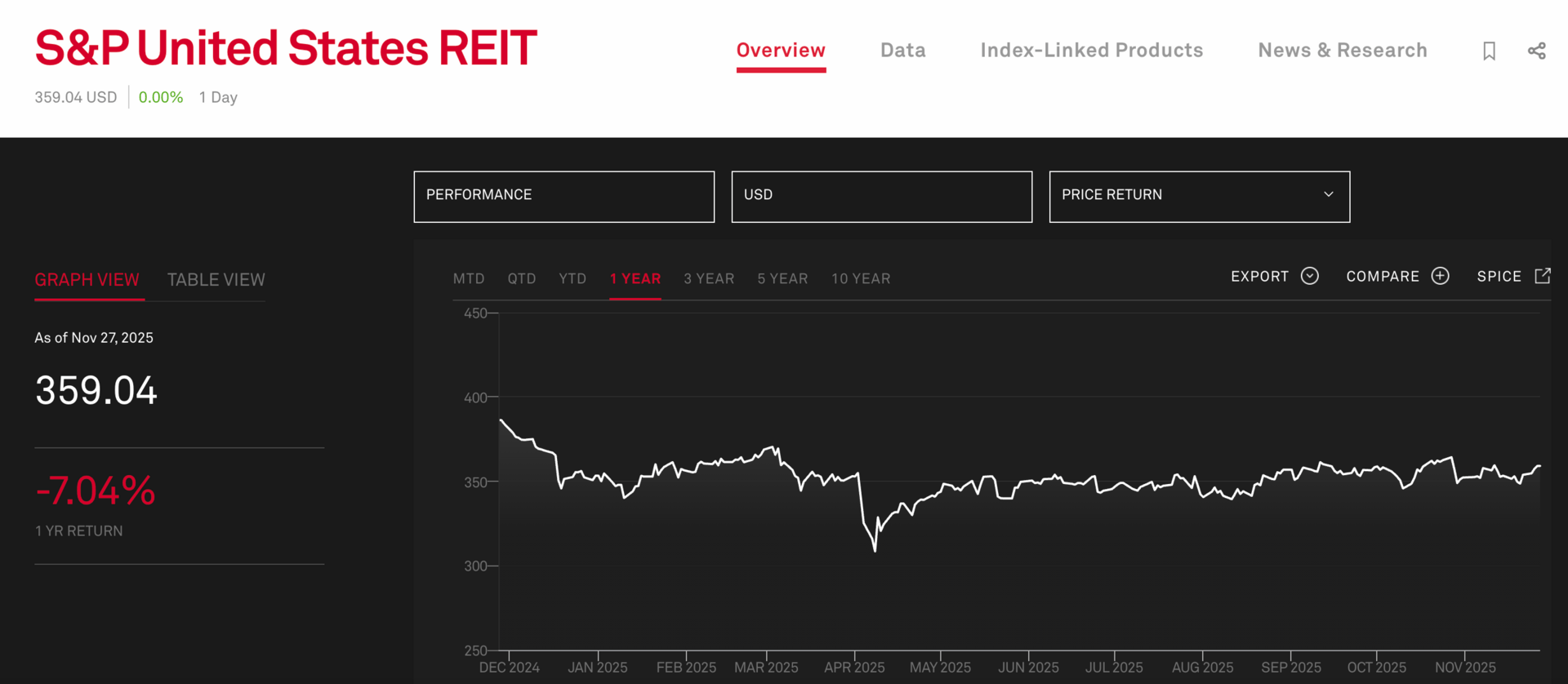

BXP, Inc. (BXP) – Complete Executive Exit from Office REIT

Transaction Details:

Insider: Peter Otteni, Executive Vice President

Action: Sale of entire 4,136-share position at $72.65

Proceeds: $300,470

Holdings After: 0 shares

Complete position exits always warrant scrutiny. While this could relate to retirement, departure, or diversification requirements, the context amplifies concerns: BXP operates as an office REIT focused on major U.S. markets—a sector still wrestling with structural headwinds.

Office REIT Market Reality:

National office vacancy hitting 20.6% in 2025

Return-to-office mandates gaining momentum but hybrid work dominant

Quality bifurcation: Class A properties outperforming by 300+ basis points

Office deliveries expected to decline 20% in 2025, 75% through 2027

The complete liquidation without offsetting insider buying anywhere in the REIT space underscores lack of conviction around commercial real estate fundamentals. Office REITs face challenges extending beyond typical cyclical patterns.

Verint Systems (VRNT) – Massive Compensation Grants Without Buying

Grant Recipients:

Dan Bodner (Chairman & CEO): 475,749 shares

Elan Moriah (President): 138,732 shares

Grant Highlander (CFO): 133,302 shares

Peter Fante (CAO): 129,877 shares

Total Granted: 877,609 shares at $0 value

Large grant packages indicate heavy stock-based compensation usage, but these transactions reveal nothing about insider conviction. The absence of ANY open-market purchases by these executives—even token amounts—speaks volumes. When leadership receives massive equity grants but won't put personal cash into the stock, they're content to wait rather than doubling down on their compensation.

Warner Bros. Discovery (WBD) – Routine Executive Sale

Transaction Details:

Insider: Lori Locke, Chief Accounting Officer

Action: Sale of 5,000 shares at $23.83

Proceeds: $119,150

Holdings After: 140,084 shares

Routine executive sale amid post-merger integration. The lack of insider buying across the entire communication services sector signals caution around legacy media business models facing streaming competition and linear TV revenue pressure.

ESCO Technologies (ESE) – Programmatic CEO Sales

Transaction Details:

Insider: Bryan Sayler, CEO & President

Action: Two sales of 401 shares each at $220

Total Proceeds: $176,440

Holdings After: 41,344 shares

Dual identical transactions likely represent pre-programmed 10b5-1 plan executions for tax obligations or diversification. Small, automated sales like these are noise rather than signal.

Dorchester Minerals (DMLP) – Energy Royalty Conviction Buy

Transaction Details:

Insider: Bradley Ehrman, CEO

Action: Open-market purchase of 2,487 shares at $21.60

Total Investment: $53,719

Holdings After: 121,197 shares

While smaller in dollar terms than Carrier's purchase, this buy carries weight in the energy infrastructure space where insider buying has been scarce. Dorchester operates as a minerals and royalties partnership—benefiting from production volumes without direct operational exposure. Ehrman's purchase signals confidence in sustained energy production economics and distribution sustainability. The only energy insider putting cash to work this week.

Geospace Technologies (GEOS) – Small Compensation Grants

Grant Recipients:

Richard Kelley (President & CEO): 8,000 shares

Ronald Bushey (CTO): 4,000 shares

Total: 12,000 shares at $0 value

Modest compensation grants reflecting smaller market cap and conservative equity compensation structure. No conviction signal.

First Interstate BancSystem (FIBK) – Banking Sector Grant

Transaction Details:

Insider: Christopher Shepler, Chief Banking Officer

Action: Grant of 1,591 shares valued at $31.42

Value: $49,989

Holdings After: 3,899 shares

Compensation grant rounds out banking activity. Complete absence of open-market purchases by bank executives reinforces cautious stance across regional banks navigating deposit competition and margin pressure.

🌊 Sector Themes

Technology: Grants Without Conviction

Activity Breakdown:

6 total transactions (highest count by sector)

4 massive grants at Verint (877,609 shares)

2 small sales at ESCO Technologies ($176K combined)

0 open-market purchases with personal capital

The tech sector's pattern reveals a troubling disconnect: executives happily collect equity compensation but won't deploy a single dollar of personal capital. When senior leaders receive hundreds of thousands of shares in grants without adding even modest positions with their own money, they're signaling a wait-and-see posture.

Software infrastructure, hardware, and equipment companies saw zero conviction buying despite recent market volatility creating potential entry points. This isn't just passive—it's actively cautious. Tech insiders are collecting their paychecks but not betting on near-term upside.

Industrials: Construction Cycle Questions

Activity Summary:

1 major buy: Carrier CEO's $1M+ purchase

1 offsetting sale: Mueller director's $460K exit

Net signal: Split decision on construction outlook

Market Context:

The industrial sector's one-for-one split captures current uncertainty around construction-related plays. HVAC manufacturers, building materials producers, and metal fabrication companies all face macro questions:

Will commercial construction activity hold up?

Are residential building trends sustainable?

Can infrastructure spending maintain momentum?

Gitlin's willingness to deploy capital at Carrier stands out precisely because it's isolated. No other industrial insider joined with conviction purchases. The sector splits between those seeing opportunity in cyclical weakness versus those preferring to harvest recent gains.

Financial Services: The Missing Cluster

Complete Absence of Conviction:

1 compensation grant at First Interstate BancSystem

1 massive sale by UWM Holdings CEO ($2.6M)

0 open-market purchases across entire sector

Regional banks, mortgage originators, and financial services companies saw no insider buying whatsoever despite stocks trading well below 2021-2022 peaks. Banks navigate earnings headwinds from deposit competition and margin compression. Mortgage companies wrestle with volume challenges in a high-rate environment.

The complete absence of insider conviction signals executives see better opportunities elsewhere or remain uncertain about near-term fundamentals. When bank insiders won't buy their own stocks even at depressed valuations, investors should pay attention.

Energy: Quiet Confidence in Minerals

Activity Breakdown:

2 grants at Geospace (equipment/services)

1 open-market purchase at Dorchester Minerals

Signal: Isolated conviction in royalties segment

CEO Bradley Ehrman's $53,719 purchase at Dorchester represents one of only two open-market buys all week. The transaction suggests he sees value in energy infrastructure at current commodity price levels. Minerals and royalties partnerships offer leveraged exposure to production volumes without operational risk.

The Missing Piece: Zero upstream or midstream insider buying leaves energy conviction isolated to the royalty segment. The absence of broader sector buying is notable amid recent commodity price stabilization.

The Missing Cluster: Where's the Buying?

Sectors With ZERO Insider Purchases:

❌ Technology (beyond compensation grants)

❌ Financial Services

❌ Real Estate / REITs

❌ Communication Services

✅ Only 2 buys: Industrials (Carrier) + Energy (Dorchester)

The Loudest Signal:

Perhaps the week's most significant data point is what didn't happen. When corporate insiders collectively step away from deploying personal capital, it reveals one of two scenarios:

Stocks haven't reached attractive risk-reward levels yet

Executives see macro uncertainty warranting patience

The Thanksgiving holiday explains some silence, but the pattern of grants and sales without offsetting purchases tells us insiders aren't rushing to capitalize on perceived opportunity in their own shares.

💡 Investor Takeaways

1. Conviction is Scarce—And That's The Signal

Two open-market purchases out of fifteen total transactions reveals insiders aren't seeing compelling value in their own stocks at current levels. When executives receive massive compensation grants but don't add personal capital, they're content to wait rather than averaging up. This collective pause speaks volumes about insider confidence (or lack thereof).

2. Carrier's CEO Stands Alone

David Gitlin's $1 million open-market purchase at CARR represents the week's only substantial insider buy—and it's in industrials/HVAC where construction concerns loom large. This isolated conviction move warrants monitoring:

Is Gitlin seeing something peers aren't?

Will other industrial insiders follow?

Or does this remain a lone bet against the tide?

3. Technology Insiders: Collecting, Not Buying

877,609 shares granted at Verint with zero open-market purchases across the entire tech sector means executives are happy to receive equity but unwilling to deploy cash. This lack of conviction persists despite recent volatility—a red flag when insiders won't bet on their own recovery thesis.

4. Financial Services & Real Estate: Complete Absence

Not a single bank executive, mortgage company insider, or REIT leader deployed capital this week. The combination of selling and grants without any offsetting purchases signals caution about near-term fundamentals in both sectors:

Banks: margin pressure + deposit competition

REITs: office sector structural headwinds

Mortgage: volume challenges in high-rate environment

5. Energy Infrastructure Shows Isolated Life

The only energy insider buy came from a minerals and royalties CEO, suggesting confidence in production economics without operational risk. Upstream and midstream insiders remain on the sidelines despite commodity price stabilization—conviction exists only in the most insulated segment of energy.

👀 WATCHLIST

Carrier Global (CARR) – Follow the CEO's Conviction

CEO David Gitlin's $1 million open-market purchase deserves continued attention.

Monitor for additional insider activity in coming weeks

Track whether other industrials executives follow suit

Watch Q4 earnings (typically early February) for HVAC demand commentary

Key question: Is this an isolated conviction call or the start of a trend?

Dorchester Minerals (DMLP) – Energy Royalty Confidence

CEO Bradley Ehrman's purchase adds to an already substantial 121,197-share position.

Monitor distribution coverage and sustainability

Track production trends across mineral holdings

Watch for additional energy insider buying (or continued absence)

Royalty structure offers production exposure without operational risk

Verint Systems (VRNT) – Testing Executive Conviction

Massive compensation grants to entire C-suite without any insider buying raises questions.

Watch for any open-market purchases in coming months

If insiders buy with personal capital = bullish signal

Continued grant-only activity = lack of conviction persists

Large grants create alignment risk if executives won't add personal capital

Mueller Industries (MLI) – Industrial Cycle Indicator

Director Scott Goldman's sale amid quiet industrials activity bears watching.

Monitor for additional industrial insider selling

Could signal construction cycle weakness concerns

Track copper prices and construction demand indicators

If more industrial insiders reduce = potential sector headwind

UWM Holdings (UWMC) – Mortgage Market Proxy

Mat Ishbia's $2.6 million sale is likely routine portfolio management, but context matters.

Watch for any acceleration in insider selling

Monitor mortgage origination volume trends

Housing affordability constraints remain headwind

Track whether other mortgage/housing insiders join selling

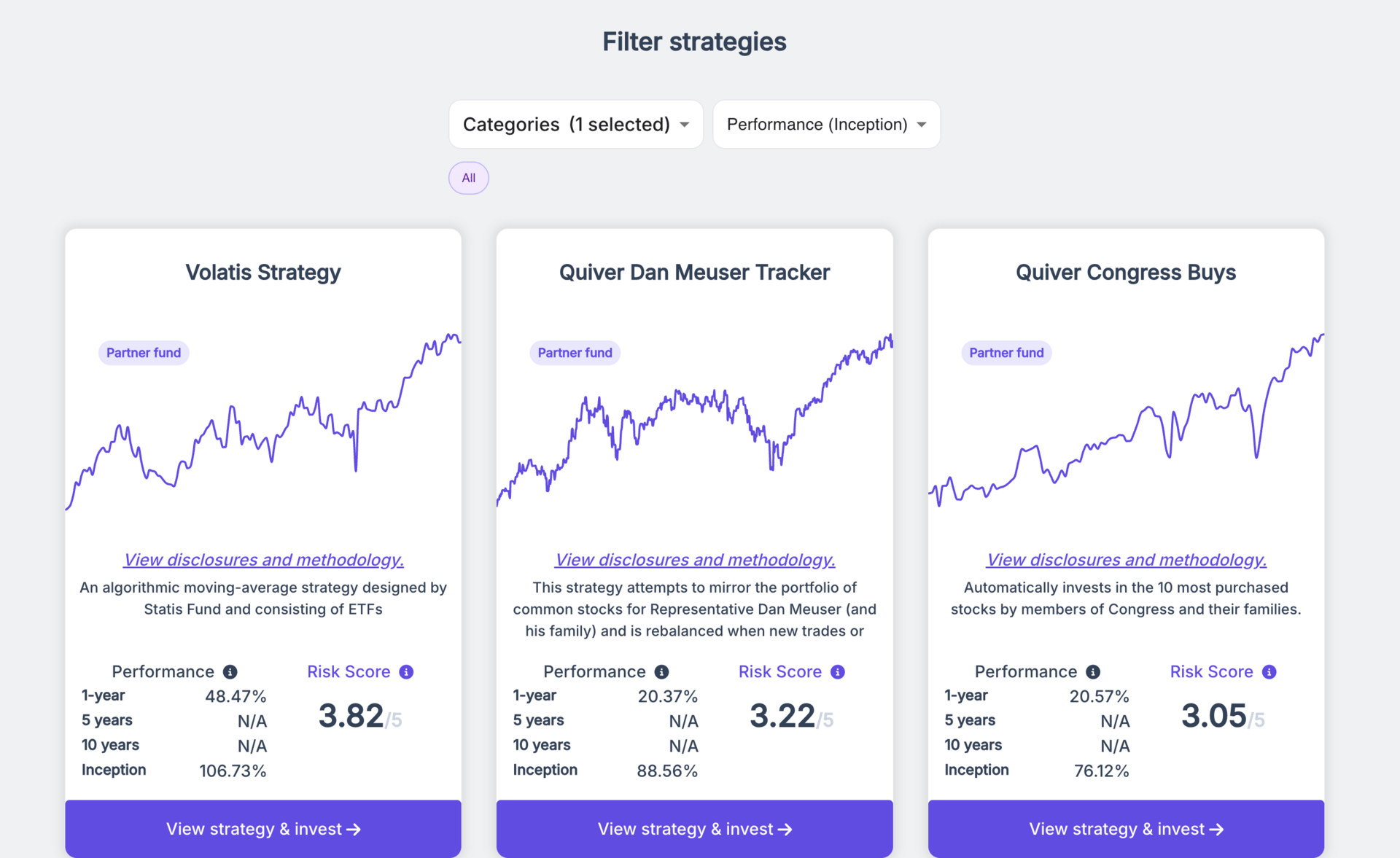

📈 Looking to copy-trade and/or invest in quantitative portfolios?

Quantbase offers both rules-based quant strategies and curated copy-trading strategies, including portfolios built on insider-trading signals. Everything runs automatically, letting you follow systematic models without the emotional noise.

👋 Closing Notes

Thanksgiving week delivered exactly what you'd expect in transaction volume—light activity ahead of the holiday. But the composition of that activity tells a more meaningful story than the calendar would suggest.

What We Learned:

Only 2 insiders across the entire market deployed personal capital through open-market purchases

Others collected compensation grants or executed routine sales

Carrier's CEO saw something worth a million-dollar bet in HVAC/building automation

Energy royalties CEO added to his position while peers stayed quiet

Everyone else either stayed put or cashed out

The Broader Message:

The absence of buying across technology, financials, real estate, and most industrials isn't panic—it's caution. Insiders are collecting their paychecks and managing their portfolios, not making bold statements about value.

Looking Ahead:

As we move into December and year-end tax planning accelerates, watch whether this pattern of limited conviction buying persists or if executives start deploying capital as valuations adjust. For now, the message is clear: corporate insiders see a market that warrants patience, not aggressive positioning.

The Few Who Disagree Are Worth Watching Closely:

Carrier CEO's $1M+ industrial bet

Dorchester CEO's energy infrastructure add

Will others follow, or do these remain lone contrarian calls?

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.