- InsiderTrackers

- Posts

- Insider Trackers: November 3-7, 2025

Insider Trackers: November 3-7, 2025

Your weekly read on where corporate insiders are moving their own money.

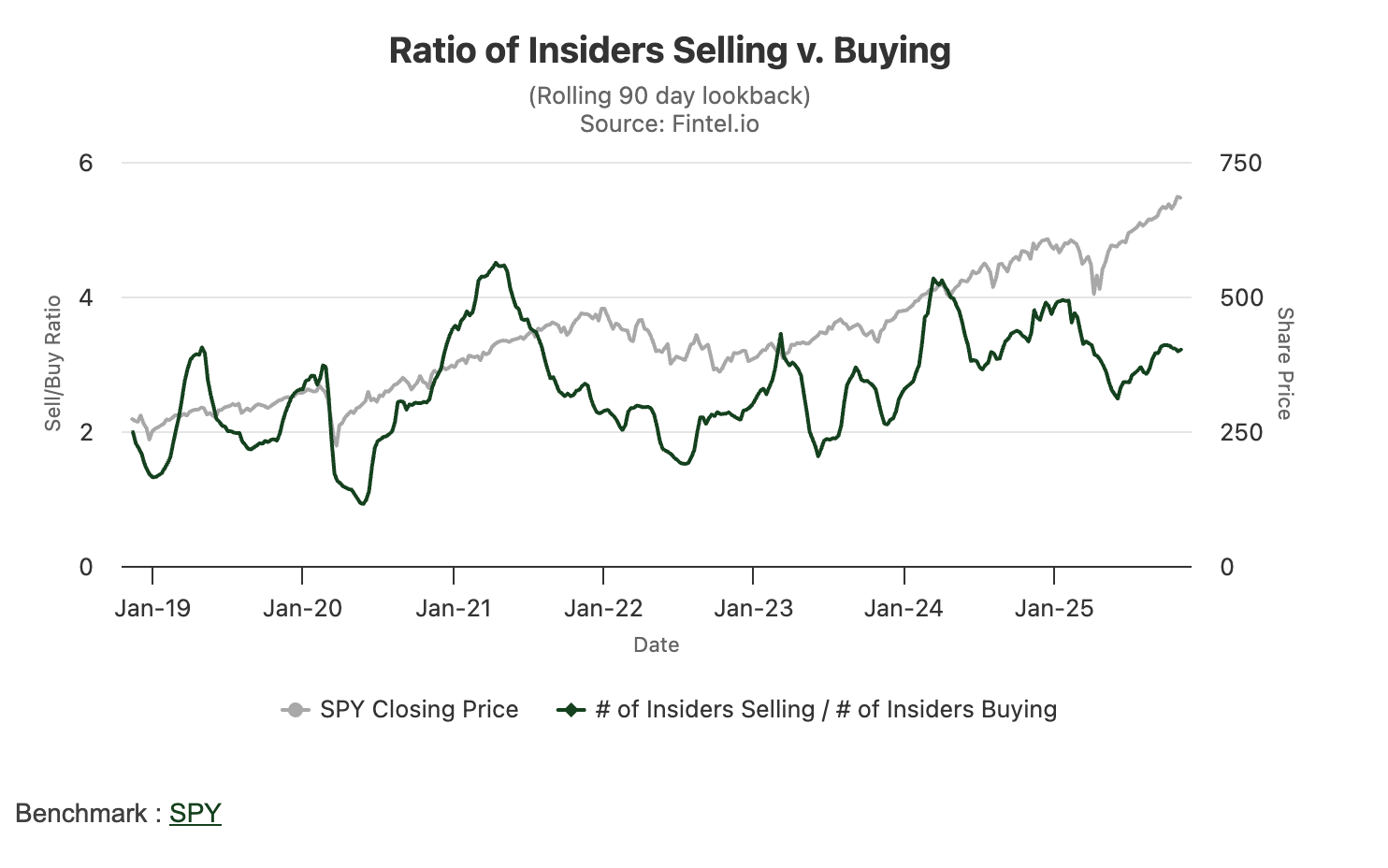

Markets may have shown volatility this week, but insider activity told a strikingly different story: executives were buying. In a rare reversal of the typical pattern where selling dominates, open-market purchases outpaced sales by more than 2.5-to-1 in dollar terms—$1.52M in real cash buys versus just $597K in sales. That's the kind of signal that cuts through the noise.

Six insiders put their own money to work this week, led by Cigna's CEO with a million-dollar vote of confidence. Meanwhile, the usual suspects—option exercises and routine compensation grants—accounted for the bulk of transaction volume, but these are noise, not signal. What matters is where insiders are writing checks from their personal accounts, and this week, they were writing them in healthcare, financials, and industrials.

When CEOs and directors are backing up their bullish talk with real capital, smart money pays attention. This week's activity suggests that at least a handful of well-positioned insiders see their companies as materially undervalued at current prices.

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

💰 Top Insider Trades

Cigna Corporation (CI) - Healthcare

CEO David Cordani made the week's most significant insider move, purchasing 4,134 shares at $241.88 for $999,916 in an open-market transaction on November 3rd. This wasn't an option exercise or a grant—this was the chairman and CEO writing a check for nearly $1 million to buy his own company's stock. Cordani now holds a substantial position post-transaction, and the timing is notable given ongoing healthcare sector volatility.

When a CEO of a major managed care company puts seven figures into the stock, it's typically because they see a disconnect between market price and intrinsic value. Cigna has been navigating regulatory pressures and margin concerns, making this buy particularly meaningful—Cordani clearly believes the worst-case scenarios are overblown.

Glacier Bancorp (GBCI) - Financial Services

Regional banking saw coordinated insider buying that can't be ignored. President/CEO Randall Chesler purchased 2,437 shares at $40.91 for $99,698 on November 5th. Two days later, Chief Experience Officer Lee Kenneth Groom added 2,425 shares at $41.26 for $100,056. Earlier in the week, EVP/CFO Ron Copher bought 2,400 shares at $41.17 for $98,808. Three C-suite executives, all buying within a $40-41 price range, all deploying roughly $100K each—this is textbook clustered insider buying and one of the strongest signals you can get from a regional bank. Glacier operates across the Mountain West and Pacific Northwest, and executive alignment like this typically precedes improved performance or consolidation catalysts.

Caterpillar Inc. (CAT) - Industrials

Director David MacLennan bought 300 shares at $568.86 for $170,658 on November 6th. At nearly $569 per share, CAT isn't cheap, but MacLennan clearly sees value even at this elevated price point. As a board member, he has visibility into order trends, dealer inventory levels, and the global construction cycle that most investors don't. This purchase, while not massive in absolute terms, signals confidence in Caterpillar's ability to sustain margins despite concerns about slowing global infrastructure spending.

Bank of Princeton (BPRN) - Financial Services

Director Susan Barrett purchased 2,100 shares at $24.00 for $50,400 on November 3rd. Another financial services insider putting fresh capital to work. While smaller in dollar terms, Barrett's buy represents a meaningful commitment for a community bank director, suggesting she sees the current valuation as attractive heading into year-end.

Yum! Brands (YUM) - Consumer Cyclical

This one requires nuance. Chief Legal Officer Erika Burkhardt exercised options on 4,073 shares at $102.87 (valued at $418,990) on November 5th, then immediately sold 1,269 shares at $149.37 for $189,551. Separately, Director Thomas Nelson exercised options on 3,096 shares at $49.66 ($153,747). These are routine option exercises, not open-market buys—executives converting long-dated options into cash, which is tax-driven and typically pre-scheduled under 10b5-1 plans. Burkhardt's partial sale after exercising is standard tax-withholding behavior. Zero signal value here.

Winmark Corporation (WINA) - Consumer Cyclical

CFO Anthony Ishaug executed multiple option exercises totaling roughly $689K across different strike prices ($98.25 and $195.82) on November 7th. Again, this is compensation realization, not fresh capital deployment. Winmark operates franchise resale businesses, but these transactions tell us nothing about Ishaug's conviction—just that his options vested and he's monetizing.

Calix (CALX) - Technology (Unclassified Sector)

Director and 10% owner Carl Russo exercised options on 400,000 shares at $12.63 (valued at $5.05M combined) on November 6th. This was the week's largest transaction by dollar value, but it's purely mechanical—Russo exercised long-dated options, a liquidity event with zero predictive value. Large shareholders exercise options for tax planning, diversification, or estate management. Don't read anything into this.

BKV Corporation (BKV) - Energy

Chief Legal and Admin Officer Lindsay Larrick sold 6,518 shares at $25.00 for $162,950 on November 6th. This was the second-largest sale of the week, but context matters—BKV is a recent IPO (energy infrastructure company), and early insider sales post-IPO are routine as executives diversify concentrated positions. Minimal signal without knowing Larrick's remaining holdings and whether this was part of a pre-arranged plan.

Greenlight Capital Re (GLRE) - Financial Services

Group Chief Underwriting Officer Thomas James Curnock sold 9,942 shares at $12.58 for $125,070 on November 7th. Reinsurance sector sale at relatively low absolute dollar amounts—likely personal liquidity or portfolio rebalancing rather than a negative fundamental view.

Nordson Corporation (NDSN) - Industrials

Director Milton Mayo Morris sold 265 shares at $231.00 for $61,215 on November 3rd. Small director sale, most likely tax-related or personal expense driven.

🌊 Sector Themes

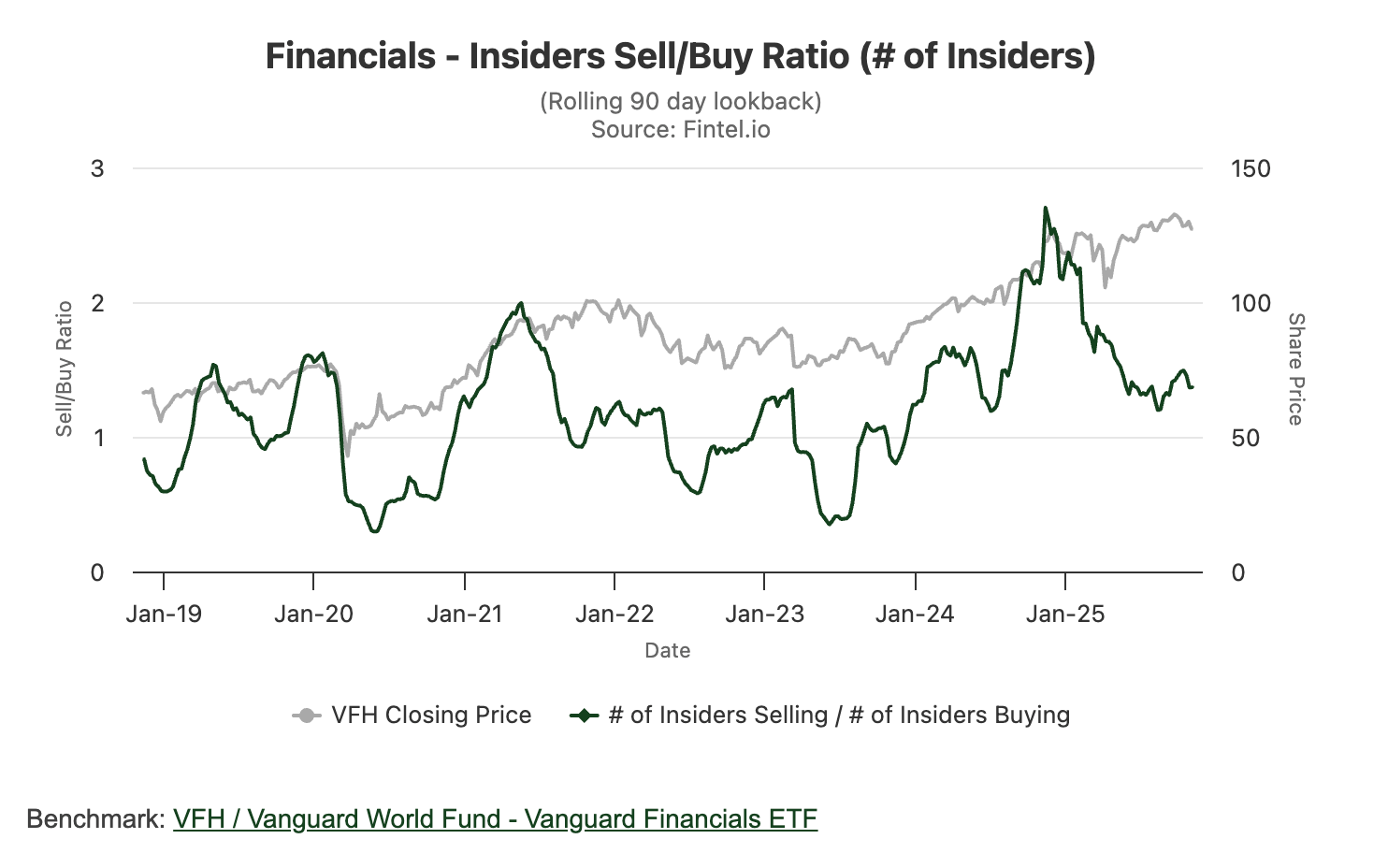

Financial Services: The Standout Cluster

Four open-market purchases, all in regional and community banks, totaling nearly $350K. Glacier Bancorp's three-executive buying spree was the week's clearest thematic signal—clustered insider buying at consistent price levels suggests management sees asymmetric upside. Regional banks have been under pressure from interest rate volatility and commercial real estate concerns, but insiders at these institutions are positioning for a recovery. Financial Services also saw one sale (Greenlight Re) and limited option activity, but the net buying activity is unmistakably bullish.

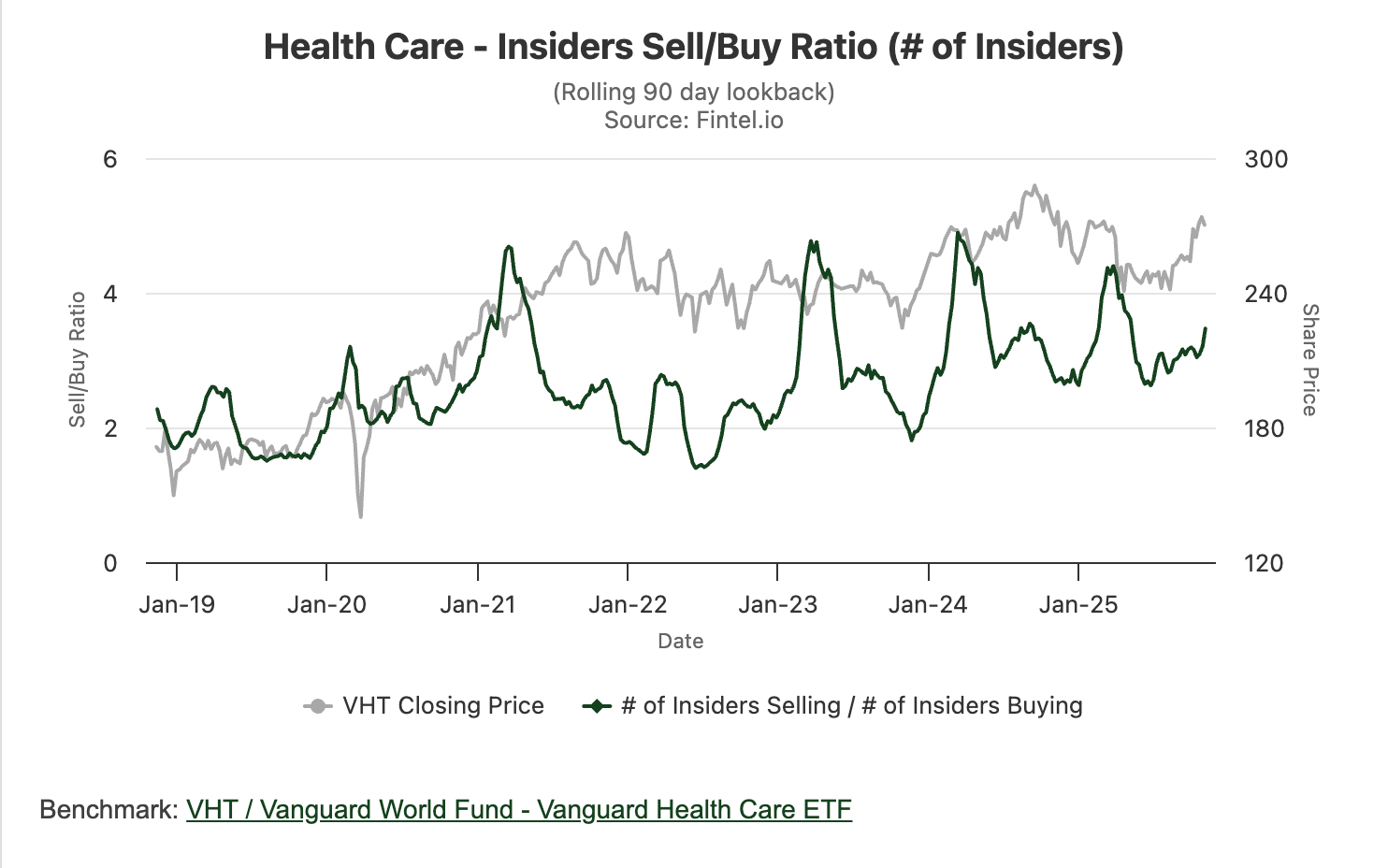

Healthcare: CEO Confidence

Cigna's David Cordani deploying $1M of personal capital was the week's headline move. Healthcare has been a challenging sector—regulatory uncertainty, drug pricing pressures, and margin compression across managed care. For the CEO of one of the nation's largest health insurers to step in with a seven-figure buy is a direct signal that he believes current valuations overstate the risks. No other meaningful healthcare activity this week, but one $1M buy speaks louder than a dozen option exercises.

Industrials: Mixed but Notable

Caterpillar's director buy at $569/share stands out—this is one of the most expensive stocks in the industrial sector, and a board member still sees value. However, Industrials also saw two director sales (Nordson and Park Aerospace), totaling $120K. The sector isn't showing unified bullishness, but CAT's buy carries weight given MacLennan's board seat and access to non-public information about the global infrastructure cycle.

Consumer Cyclical: All Noise, No Signal

Yum! Brands and Winmark dominated transaction volume in Consumer Cyclical, but every single trade was either an option exercise or a post-exercise sale. Eight transactions totaling $1.8M, and zero were open-market purchases. This sector provided exactly zero actionable intelligence this week. Option exercises are compensation events—executives realizing value from long-dated grants. They tell you nothing about forward outlook.

The Missing Cluster: Energy & Communication Services

Energy saw one sale (BKV's Chief Legal Officer) and one grant, but zero buying. Communication Services (Shenandoah Telecom) had only routine grants. These sectors were effectively absent from meaningful insider activity this week, suggesting either limited insider conviction or a wait-and-see posture. When sectors disappear from the buy side, it's often because insiders don't see near-term catalysts worth deploying capital against.

Investor Takeaways

Rare Bullish Setup: Open-market buys exceeded sales by 2.5x ($1.52M vs $597K)—a highly unusual week where insiders were net aggressive buyers. This doesn't happen often, and when it does, it's worth noting.

Financial Services = Actionable Theme: The Glacier Bancorp triple-executive buy is as close to a coordinated bullish signal as you'll find in insider data. Three C-suite officers, all buying ~$100K worth in a two-day window, all at $40-41/share—that's conviction.

Healthcare Large-Cap Value Play: Cigna's CEO buying $1M of stock at $242 is a bet on mean reversion. If you believe Cordani has better visibility into regulatory outcomes and margin trends than the market, this is a high-conviction signal.

Ignore the Option Exercise Theater: Over $7M in option exercises this week, almost entirely at Yum!, Winmark, and Calix—all meaningless. Option exercises ≠ insider conviction. Filter them out completely.

Industrial Selective Optimism: Caterpillar's director buy at $569 suggests someone with inside access believes the market is underpricing CAT's ability to sustain margins in a decelerating global economy. Worth a deeper look.

👀 Watchlist

GBCI (Glacier Bancorp) - Three executives buying in lock-step at $40-41 is the week's strongest technical insider signal. Regional banks have been beaten down, and this coordinated buying suggests management sees the trough.

CI (Cigna) - CEO Cordani's $1M buy makes this a must-watch. If healthcare volatility continues and Cigna trades lower, Cordani may add to his position. Watch for follow-on activity.

CAT (Caterpillar) - Director MacLennan's buy at all-time high prices is contrarian. If global infrastructure spending holds up better than feared, CAT has room to run. The insider buy validates current valuation.

YUM (Yum! Brands) - Despite heavy option exercise activity, zero open-market buying signals caution. Option exercises are noise, but the absence of real buying at a mature consumer brand is worth noting. Not on the buy list.

BKV (BKV Corporation) - Recent IPO with early insider selling. Monitor for stabilization of insider activity before considering a position. Selling immediately post-IPO is normal, but sustained selling would be a red flag.

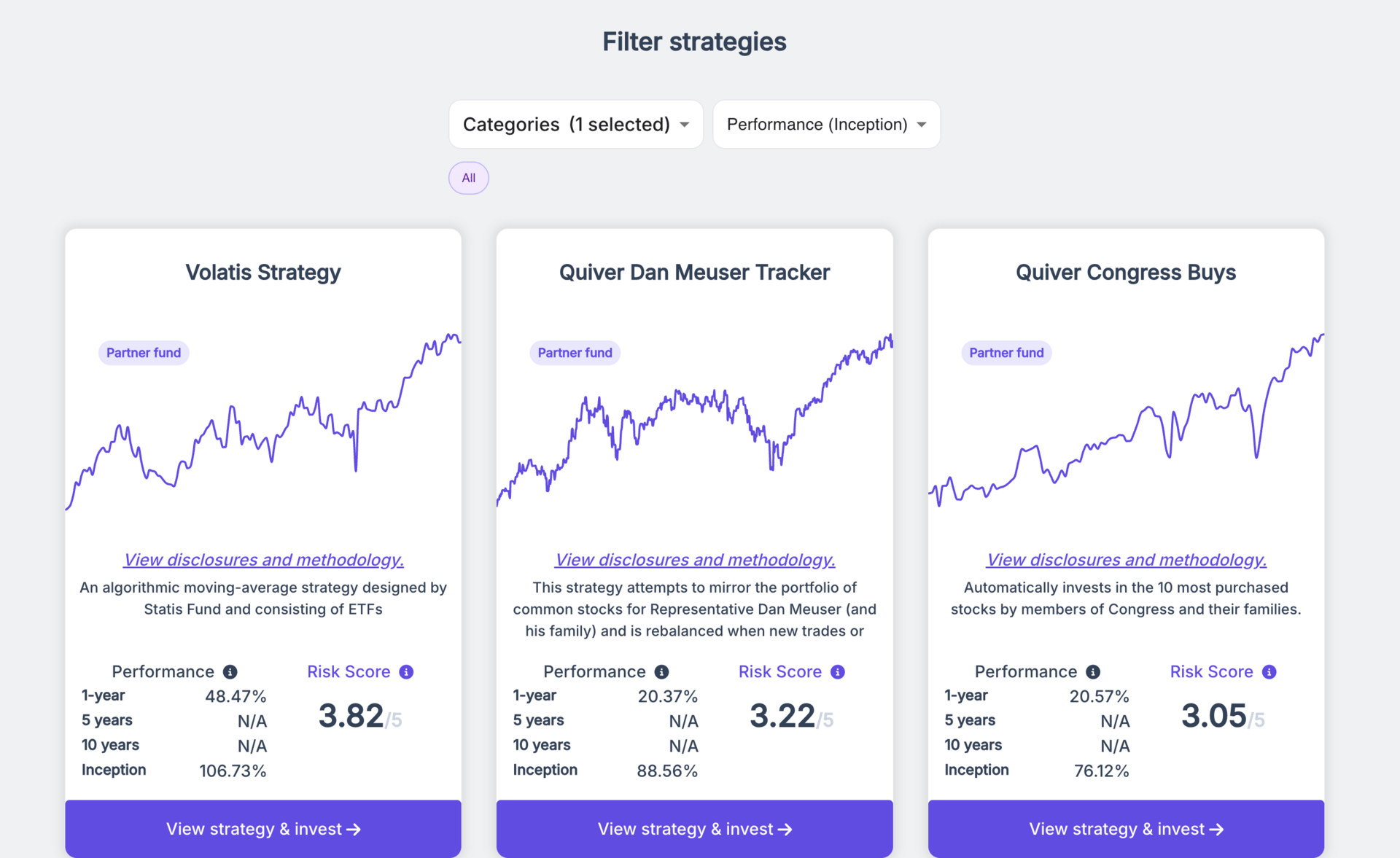

📈 Looking to copy trade?

If you're interested in automatically following insider trading strategies, check out the quantitative trading strategies available on Quantbase. They offer systematic approaches to insider trading signals that remove emotion from the equation.

👋 Closing Notes

This was an unusually constructive week for insider activity, flipping the typical script where selling dominates. Six open-market purchases versus five sales, with buys outpacing sells in dollar terms by a meaningful margin. The standout themes were Financial Services clustering (Glacier Bancorp's C-suite buying spree) and Healthcare large-cap conviction (Cigna's CEO deploying $1M).

Ignore the noise—$7M in option exercises at Yum!, Winmark, and Calix tell you nothing. Focus on where executives are writing personal checks: regional banks, managed care, and select industrials. These are the pockets where insiders see value that the market hasn't priced in yet.

As we head into the final weeks of 2025, watch whether this buying pressure sustains or was an isolated week of opportunistic positioning. If more C-suite executives start deploying capital, it could signal a broader shift in insider sentiment heading into year-end.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.