- InsiderTrackers

- Posts

- Insider Trackers: October 20-24, 2025

Insider Trackers: October 20-24, 2025

Your weekly read on where corporate insiders are moving their own money.

The market continues its climb, but corporate insiders aren't buying the rally. This week's insider activity tells a stark story:

$11.9M in sales vs. $4M in purchases (one questionable micro-cap buy)

15 transactions across 8 companies, dominated by option exercises and routine selling

Zero meaningful open-market purchases from established companies

Healthcare: option monetization only

Tech: founder diversification

Financial services: systematic exits

When executives who know their businesses best choose to sell rather than accumulate, that's a signal worth noticing.

Tech moves fast, but you're still playing catch-up?

That's exactly why 100K+ engineers working at Google, Meta, and Apple read The Code twice a week.

Here's what you get:

Curated tech news that shapes your career - Filtered from thousands of sources so you know what's coming 6 months early.

Practical resources you can use immediately - Real tutorials and tools that solve actual engineering problems.

Research papers and insights decoded - We break down complex tech so you understand what matters.

All delivered twice a week in just 2 short emails.

💰 Top Insider Trades

BrightSpring Health Services (BTSG) dominated the week with $10.6M across six transactions:

Jon B. Rousseau (Director/Officer):

Exercised 470,000 options at $6.37

Sold 235,000 shares at $28.78 = $6.76M

Spread: $22.41/share profit

Still holds 1.1M+ shares

Lisa A. Nalley (Officer):

Exercised 40,000 options at $6.37

Sold 20,000 shares at $28.78 = $576K

Maintains substantial position

Signal: ⚠️ Neutral – Standard option exercise-and-sell. This is compensation monetization, not a bearish thesis. Both executives retain significant holdings.

NUGN (Unknown/Micro-cap) – The week's only "open-market" purchase:

Michael Gregory Max Henriksen (CIO, 10% owner):

Purchased 2 billion shares at $0.002/share = $4M

Date: October 22

Now owns 3B+ shares

Red flags:

Filing shows "(NUGN" as ticker AND company name

No sector, industry, or basic company info disclosed

Pink sheets/OTC territory with minimal transparency

$0.002/share pricing screams micro-cap speculation

Signal: ⚠️ Cautious Watch – While technically a $4M commitment, the lack of transparency makes this impossible to analyze. Real conviction buying comes with disclosure; this comes with question marks.

UWM Holdings (UWMC) – Mortgage lender CEO continues systematic selling:

Mat Ishbia (CEO, 10% owner):

Sold 596,356 Class A shares at $5.73 = $3.42M

Still holds 4.8M shares

Systematic diversification in tough mortgage market

Signal: ⚠️ Neutral – Pre-programmed 10b5-1 sales, not panic. Standard diversification for concentrated position.

UiPath (PATH) – AI automation platform sees founder/exec selling:

Daniel Dines (CEO, Chairman, Founder):

Sold 45,000 shares at $15.57 = $701K

Still holds 29.8M shares

Hitesh Ramani (Chief Accounting Officer):

Sold 10,000 shares at $15.68 = $157K

Signal: ⚠️ Neutral – Standard 10b5-1 programmatic sales. Tax planning and diversification, not crisis of faith.

Hagerty (HGTY) – Classic car insurer director trim:

Robert I. Kauffman (Director):

Sold 12,219 shares at $11.19 = $137K

Retains 952,593 shares

Signal: ⚠️ Neutral – Tiny trim, likely personal liquidity.

Mueller Industries (MLI) – Industrials director maintenance sale:

John B. Hansen (Director):

Sold 1,000 shares at $105.71 = $106K

Still holds 91,664 shares

Signal: ⚠️ Neutral – Classic portfolio maintenance. $106K tells us nothing.

Prosperity Bancshares (PB) – Regional bank compensation grants:

Kevin J. Hanigan (President & COO): 30,000 shares granted

J. Mays Davenport (EVP): 10,000 shares granted

Standard annual/performance-based equity compensation

Signal: ⚠️ Neutral – No cash exchanged, routine compensation.

Blackboxstocks (BLBX) – Trading software CTO sells:

Charles Brandon Smith (CTO):

Sold 9,167 shares at $9.08 = $83K

Retains 27,513 shares

Signal: ⚠️ Neutral – Sub-$100K planned liquidity in volatile small-cap.

🌊 Sector Themes

Healthcare: Option Exercises Masking as Activity

6 transactions, all from BrightSpring Health Services

$3.25M in option exercises + $7.34M in stock sales

Zero open-market purchases

Pattern: Executives converting compensation at $6.37 strike → selling at $28.78

Not conviction—just liquidity events

Healthcare stocks rallying on GLP-1 and robotics hype, but insiders aren't buying

Financial Services: Steady Sellers, Zero Buyers

4 transactions across 3 companies (UWMC, HGTY, PB)

Mat Ishbia (UWMC): Systematic mortgage sector selling continues

Prosperity Bancshares: Routine equity compensation only

Hagerty: Director trim

Challenges: Margin pressure (regional banks), volume declines (mortgage), pricing cycles (insurance)

Zero purchases – Financial services in harvest mode, not accumulation mode

Technology: The Founders' Exit

3 sales across 2 companies (PATH, BLBX)

Daniel Dines (UiPath): Steady diversification as AI reshapes RPA landscape

All sales were pre-programmed (10b5-1 plans)

Zero technology insiders bought shares

Tech leaders converting paper wealth to cash while valuations hold

Industrials: One Small Sale

Single transaction: Mueller Industries director sold $106K

Construction activity softening, input costs stabilizing

No major insider activity = no meaningful signals

The Missing Cluster: Consumer, Energy, Everything Else

What didn't happen speaks volumes:

No consumer discretionary or staples

No energy or materials

No real estate or utilities

No telecom or basic materials

Either insiders see nothing worth buying, or nothing urgent to sell. In a market where smart money should accumulate if they see value, the silence is deafening.

Investor Takeaways

Insiders are sellers, not buyers: $11.9M in sales vs. $4M in purchases (questionable micro-cap). When people with perfect information choose liquidity over accumulation, take notice.

Healthcare activity = compensation noise: BrightSpring's $10.6M tells us nothing about fundamentals—just executives monetizing options. Real conviction shows up in open-market purchases, not option exercises.

The confidence gap is widening: One meaningful purchase across 8 companies and multiple sectors. Insiders with intimate business knowledge aren't deploying personal capital.

Watch for sector rotation signals: If insiders start accumulating in overlooked sectors (energy, consumer staples, industrials), that signals where smart money sees opportunity. This week: zero.

Quality > quantity: One real open-market purchase from a credible insider in a transparent company means more than ten option exercises. Until CEOs/CFOs deploy meaningful capital in established companies, insider sentiment remains cautious.

👀 Watchlist

BrightSpring (BTSG): Two execs sold $10M+ this week. Watch whether insiders accumulate at lower levels or keep exiting. Buying would signal confidence in healthcare consolidation play.

UiPath (PATH): Founder Dines continues systematic selling as AI reshapes automation. If he slows/stops, it suggests confidence PATH can leverage AI vs. being displaced.

UWM Holdings (UWMC): Ishbia's programmatic selling continues in tough mortgage market. A pause would signal he sees bottom in volumes or margin pressure easing.

Prosperity Bancshares (PB): Standard compensation grants, but watch for open-market purchases. Insider buying would signal regional banks have found footing after rate turbulence.

Mueller Industries (MLI): One small sale, but watch industrials broadly. If insiders in manufacturing/construction start accumulating, it signals slowdown is priced in and recovery ahead.

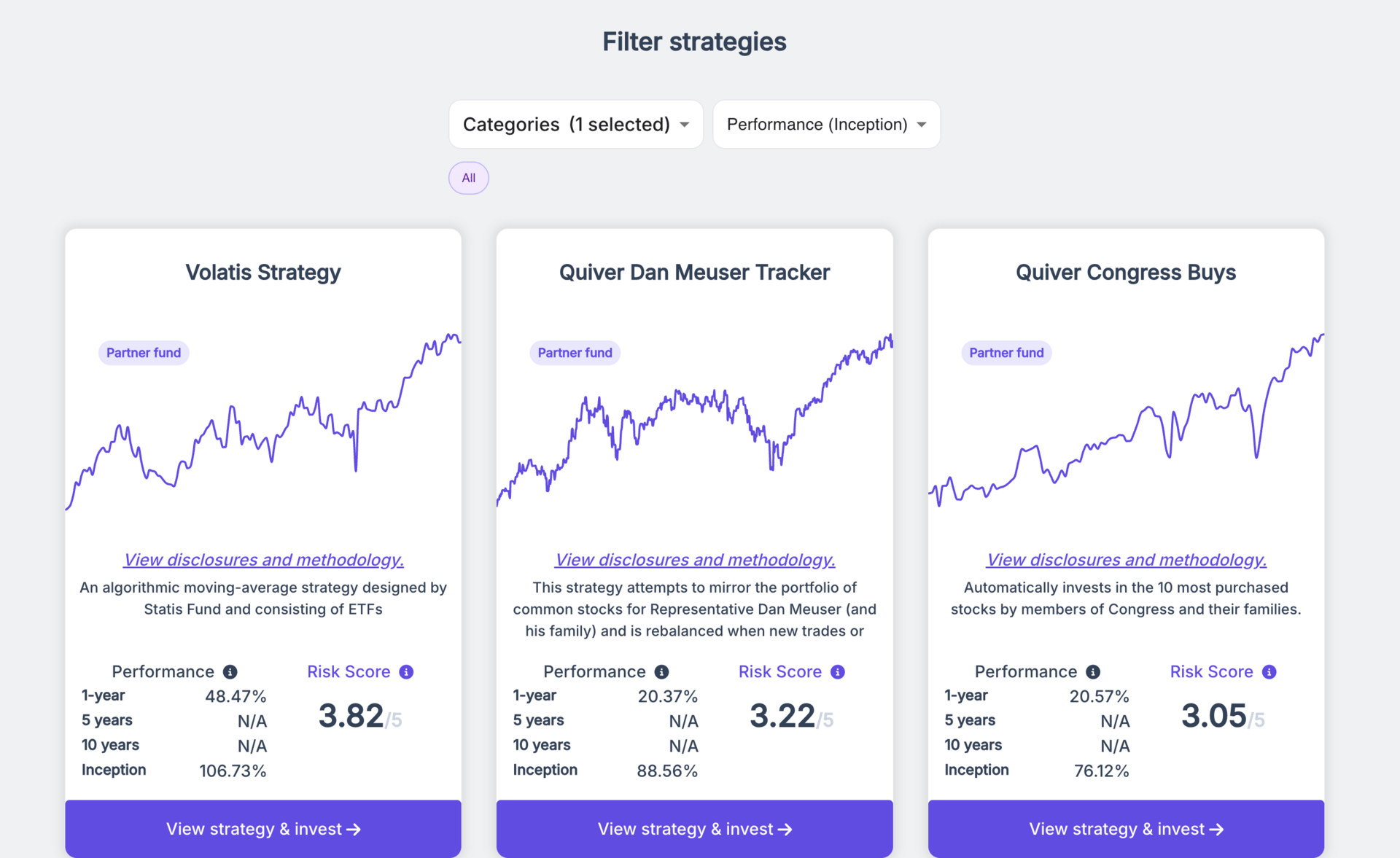

📈 Looking to copy trade?

If you're interested in automatically following insider trading strategies, check out the quantitative trading strategies available on Quantbase. They offer systematic approaches to insider trading signals that remove emotion from the equation.

👋 Closing Notes

Here’s what happened this week:

Routine selling and compensation monetization dominated

Zero meaningful open-market purchases from established companies

Insiders happy to cash out, unwilling to deploy fresh capital

Markets climbing typically see insiders step in when they spot value. Instead, we saw executives quietly exit while refusing to accumulate. For professional investors, insider buying is a leading indicator. When insiders buy, they're betting their own money on future performance. When they sell, it could mean anything. When they do neither—when they exit but refuse to buy—ask whether the market is pricing in growth that may not materialize.

Next week, watch for change: If CFOs, CEOs, or directors start making open-market purchases, that's the signal insiders believe risk/reward has tilted in their favor. Until then, the message from C-suites is clear: they'd rather have cash than equity at these prices.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.