- InsiderTrackers

- Posts

- Insider Trackers: October 27-31, 2025

Insider Trackers: October 27-31, 2025

Your weekly read on where corporate insiders are moving their own money.

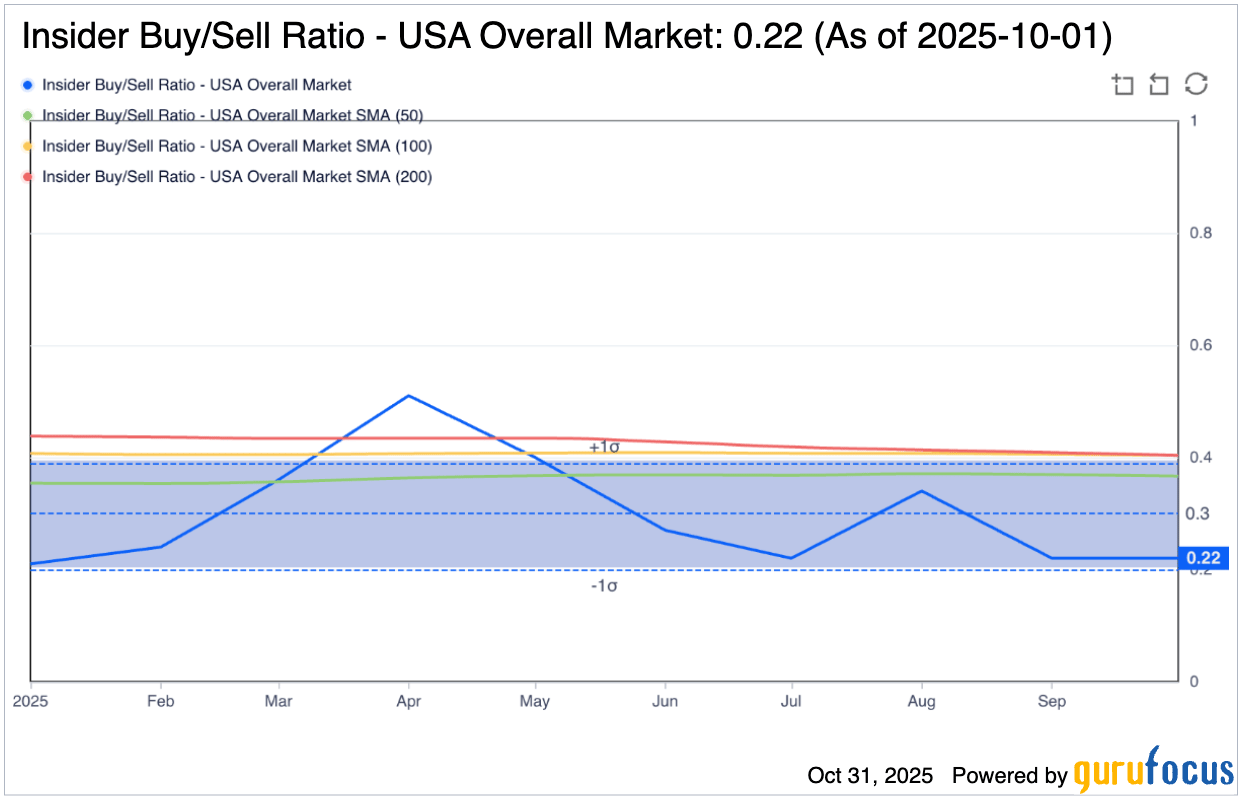

While Wall Street fixates on earnings beats and Fed speak, the real signal hides in plain sight: what insiders do with their own money. This week told a surgical story—$20.78M in sales versus $5.26M in purchases, but the ratio misses the point. Location matters more than volume.

Across 34 transactions and 18 companies, regional bank directors wrote checks while biotech executives cashed out. Healthcare dominated with 12 trades—all selling. Financial Services saw half that volume—mostly buying. When insiders diverge this sharply by sector, pay attention.

Institutional-Grade Opportunities for HNW Investors

Long Angle is a private, vetted community connecting high-net-worth entrepreneurs and executives with institutional-grade alternative investments. No membership fees.

Access top-tier opportunities across private equity, credit, search funds, litigation finance, energy, hedge funds, and secondaries. Leverage collective expertise and scale for better terms.

Invest alongside pensions, endowments, and family offices. With $100M+ invested annually, secure preferential terms unavailable to individual investors.

💰 Top Insider Trades

Celestica Inc. (CLS) — Four Buys, One Message

Director Laurette T. Koellner wasn't messing around. Four separate purchases on October 30th. $2.05M total. Prices climbing from $341 to $342—she chased it higher.

The details:

Largest buy: $1.10M (3,227 shares)

All executed near 52-week highs

Canadian electronics manufacturer in AI infrastructure space

When a director makes multiple purchases in a single session at rising prices, they're not catching knives. They're front-running something. Celestica manufactures components for hyperscalers and AI data centers. With capex cycles extending into 2026, Koellner apparently sees the order book swelling, not shrinking.

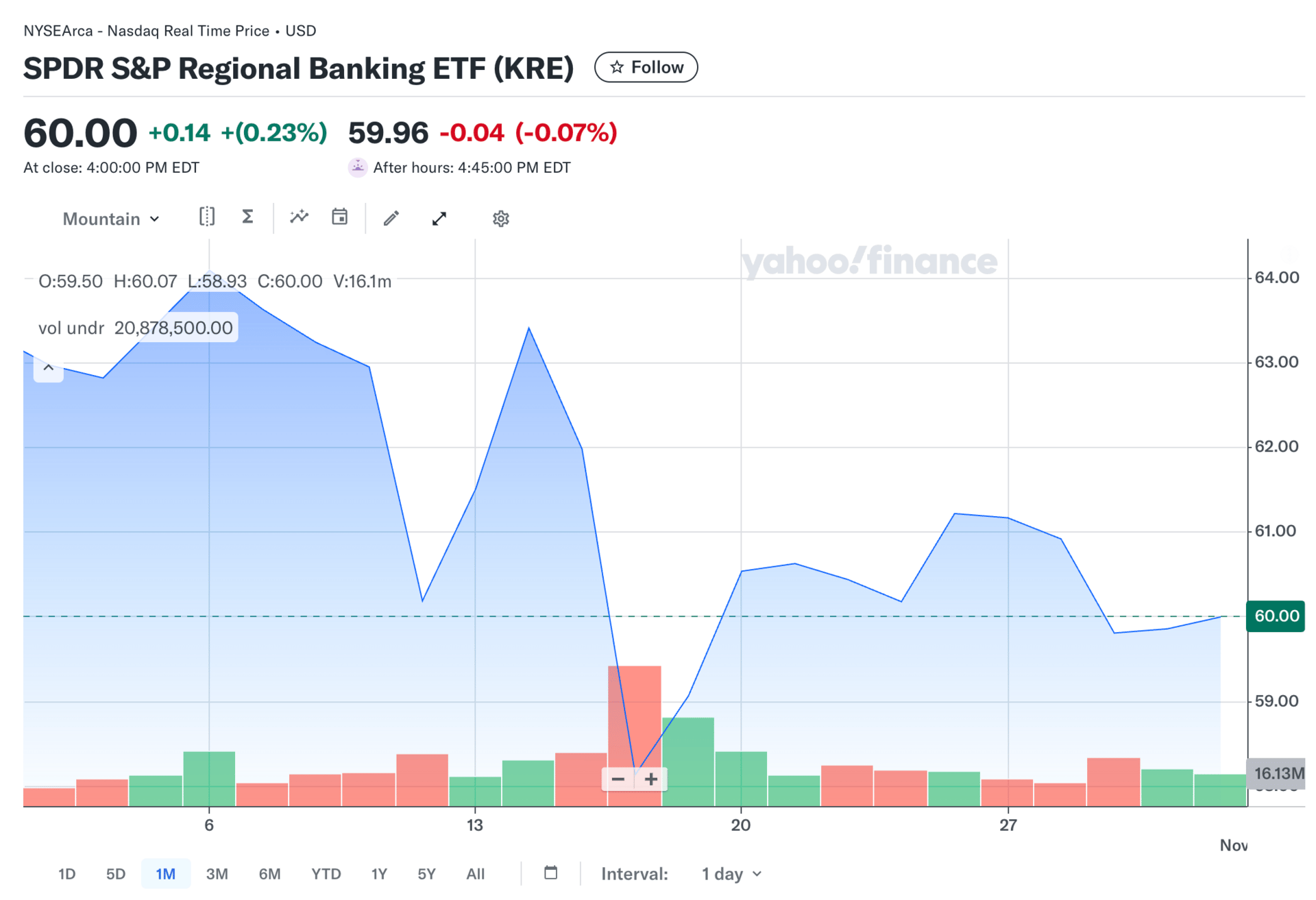

Executive Chairman Robert Francis Rivers didn't nibble. 50,000 shares at $17.21 on October 28th. $860,500 out of pocket.

This is a top executive at a Massachusetts regional bank writing a near-million-dollar personal check during banking sector volatility. Rivers has visibility into every loan, every deposit, every credit migration. When someone with that knowledge deploys this capital, they're broadcasting confidence in asset quality and earnings power that the market isn't seeing.

Eastern avoided the commercial real estate landmines that sank peers. Rivers' purchase suggests he thinks the discount is overdone.

Origin Bancorp (OBK) — COO and CFO Buy Together

Martin Lance Hall (COO) and William J. Wallace IV (CFO) both bought on October 30th. $130,388 combined at $37.50.

Why this matters:

COO sees operations → knows loan quality

CFO sees financials → knows profitability

Both bought simultaneously → aligned conviction

This Louisiana/Texas/Mississippi bank operates in resilient markets. When the two executives who see both sides of the business write $50K-$80K checks on the same day, they're not worried about credit deterioration.

MidWestOne Financial (MOFG) + Burke & Herbert (BHRB) — Community Bank Conviction

CEO Charles N. Reeves at MidWestOne: $52,900 purchase.

Director Shawn Patrick McLaughlin at Burke & Herbert: $61,000 purchase.

Small dollars, big signal. Community bank insiders in Iowa and Virginia using personal capital. These aren't token gestures at their compensation levels—they're statements about local market strength and deposit stability.

UWM Holdings (UWMC) — Billionaire Diversification

CEO Mat Ishbia sold $6.88M across two days (October 27, 29). Pre-programmed 10b5-1 sales. Owns 93% of the company.

The math: 0.02% of his total stake. This is a billionaire converting illiquid equity into vacation homes, not a CEO fleeing the business. UWMC's mortgage business faces rate sensitivity, but Ishbia's been on this selling schedule all year. Ignore the noise.

United Therapeutics (UTHR) — Textbook Option Exercise

General Counsel Paul A. Mahon ran the standard executive playbook on October 30th:

Exercised 22,000 options at $135.42

Immediately sold at $447-$452

$7.37M in transactions

Classic compensation monetization. Exercise cheap options, recognize taxable income, sell to cover taxes and lock gains. United Therapeutics stock has run hard on strong commercial performance. This reflects wealth management, not business concern.

Travel + Leisure (TNL) + J.B. Hunt (JBHT) — Routine Profit-Taking

Jeffrey Myers (TNL officer): Sold 50,000 shares, $3.32M

Darren P. Field (JBHT EVP): Sold 6,500 shares, $1.10M

Both look like portfolio rebalancing after appreciation. Travel + Leisure rode the leisure recovery. J.B. Hunt navigates choppy freight markets but maintains market leadership. Without evidence of discretionary selling versus pre-programmed, these read as normal executive liquidity.

UiPath (PATH) — Founder's Systematic Exit

CEO Daniel Dines sold $1.44M over two days. 10b5-1 program. Founder with 10% ownership.

The RPA sector faces AI disruption anxiety, but Dines' sales follow a preset schedule and represent a fraction of his stake. UiPath trades 75% below 2021 highs—if Dines thought catastrophe loomed, he'd accelerate the exits. This is measured diversification, not panic.

🌊 Sector Themes

Regional Banking: Coordinated Confidence

Multiple bank executives bought the same week. Different states. Different markets. Same message.

Who bought:

Eastern Bankshares Executive Chair: $860K

Origin Bancorp COO + CFO: $130K combined

MidWestOne CEO: $53K

Burke & Herbert Director: $61K

This isn't random. These insiders understand deposit betas, credit migration, and net interest margins better than any analyst covering them. Their willingness to deploy personal capital after a year of sector volatility—driven by rate fears and CRE concerns—signals they see stabilization the market doesn't.

Eastern's $860K purchase particularly stands out. When an Executive Chairman in Massachusetts writes that check, he's not worried about loan losses. He's betting the market overshot on risk pricing.

Regional banks got oversold. Insiders see value that institutional money is missing.

Technology Hardware: The AI Infrastructure Bet

One insider. One day. Four purchases. $2.05M.

Celestica director Laurette Koellner didn't just buy—she chased the stock higher at $341-$342. Near 52-week highs. That's not value hunting. That's someone who sees the order pipeline and knows what's coming.

Celestica manufactures components for AI data centers, hyperscalers, and networking equipment. With AI capex cycles extending through 2026 and tech giants spending record amounts on infrastructure, Koellner apparently believes the revenue visibility is strong.

Meanwhile, UiPath's CEO continued systematic selling. Two different tech stories:

AI infrastructure (Celestica): Director buying aggressively

Legacy software automation (UiPath): Founder diversifying on schedule

The divergence matters. Follow the capital into AI infrastructure plays. The software automation space faces generative AI disruption questions.

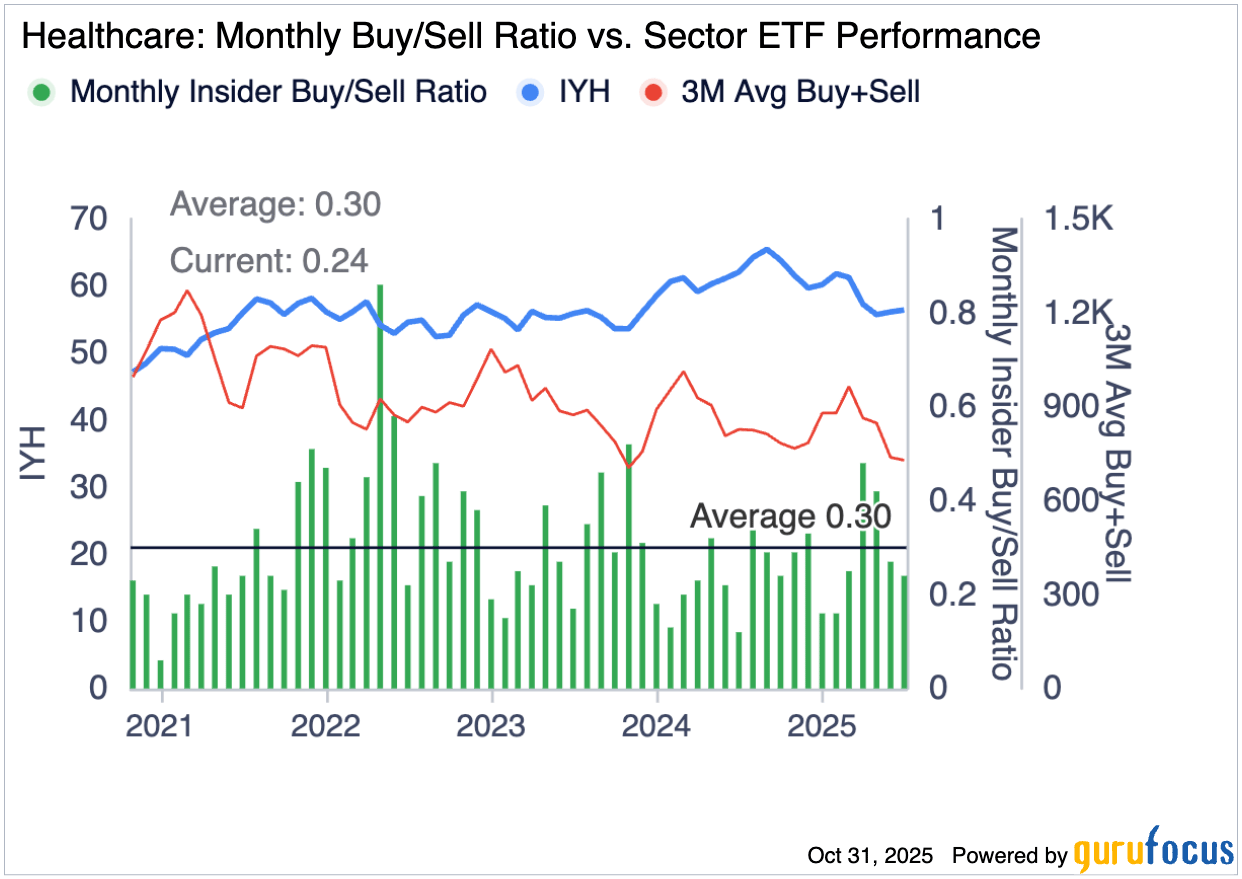

Healthcare/Biotech: Nobody's Buying

Twelve transactions. $8.60M in volume. Highest activity of any sector. Zero open-market purchases.

What we saw:

United Therapeutics: Option exercises and systematic sales

Cytokinetics CEO: $314K sale

Various biotech insiders: Routine compensation liquidation

Biotech insiders have the best visibility into pipelines, regulatory timelines, and commercial traction. When they're not buying—even after sector pullbacks—they're telling you something. Current prices don't scream opportunity to the people who know best.

Every transaction was compensation-related. Exercise and sell. Vest and liquidate. Nobody converting cash into equity.

The message: Biotech insiders are raising cash, not deploying it. Wait for them to start buying before getting aggressive.

Consumer: The Silent Sector

One transaction. Travel + Leisure officer selling $3.32M. That's it.

What didn't happen:

No retail insider buying

No restaurant executives adding

No leisure company directors deploying capital

No consumer staples purchases

When insiders believe their companies are cheap, they act. This week, consumer-facing insiders did nothing. That silence speaks—either valuations aren't compelling or they're uncertain about spending power heading into 2026.

The takeaway: Consumer insiders are on the sidelines. No conviction either way.

The Missing Sectors

Perhaps most telling: zero insider buying in energy, industrials (beyond one manufacturer), real estate, or consumer staples.

When entire sectors show no insider purchases during market volatility, it suggests insiders across those industries don't see their stocks as particularly undervalued. The concentration of buying in just two areas—regional banks and one AI infrastructure play—tells you the opportunity set is narrow.

Insiders aren't broadcasting broad optimism. They're making surgical bets where they see specific value.

Investor Takeaways

Regional banks are flashing green. Multiple executives across different institutions bought the same week. When insiders with complete visibility into credit quality and deposits deploy personal capital after sector volatility, that's a signal. Consider well-capitalized regional banks with limited CRE exposure.

AI infrastructure still has runway. Celestica's director deployed $2M near highs—suggesting the capex cycle has more room. Hardware and components tied to data center buildouts may be early innings, not late.

Biotech needs buyers first. Zero open-market purchases despite pullbacks means insiders don't see compelling risk-reward yet. Wait for them to start buying before deploying capital aggressively.

Ignore programmatic selling. UWMC's Ishbia and UiPath's Dines continued scheduled 10b5-1 sales representing tiny ownership fractions. These are liquidity management, not business concerns. Don't confuse preset programs with discretionary exits.

Watch for follow-through. First buys are interesting. Repeated buys are confirmatory. If Eastern's Executive Chair, Celestica's director, or Origin's executives keep adding in coming weeks, the conviction thesis strengthens.

👀 Watchlist

Eastern Bankshares (EBC)

The Executive Chair's $860K purchase demands attention. If Q4 shows solid results with stable deposits and benign credit, this insider buy could mark a local bottom for regional bank valuations. Watch for any additional purchases.

Celestica Inc. (CLS)

Four purchases totaling $2M from a director near 52-week highs is unusual. Monitor upcoming earnings for AI-related order commentary and 2026 revenue guidance. Strong pipeline could trigger broader institutional accumulation.

Origin Bancorp (OBK)

Dual C-suite buying (COO + CFO) signals both operational and financial confidence. Watch quarterly results for loan growth and credit stability across Texas/Louisiana/Mississippi footprint. Any additional insider buying would be highly bullish.

MidWestOne Financial (MOFG)

CEO buying at a community bank always merits tracking. If deposit costs stay favorable and credit remains clean, this overlooked Iowa bank could benefit from flight-to-quality dynamics.

United Therapeutics (UTHR)

This week's selling was routine option monetization. But if insiders start making open-market purchases after this cycle completes, it would signal powerful conviction. PAH commercial momentum remains strong—watch for any buying to emerge.

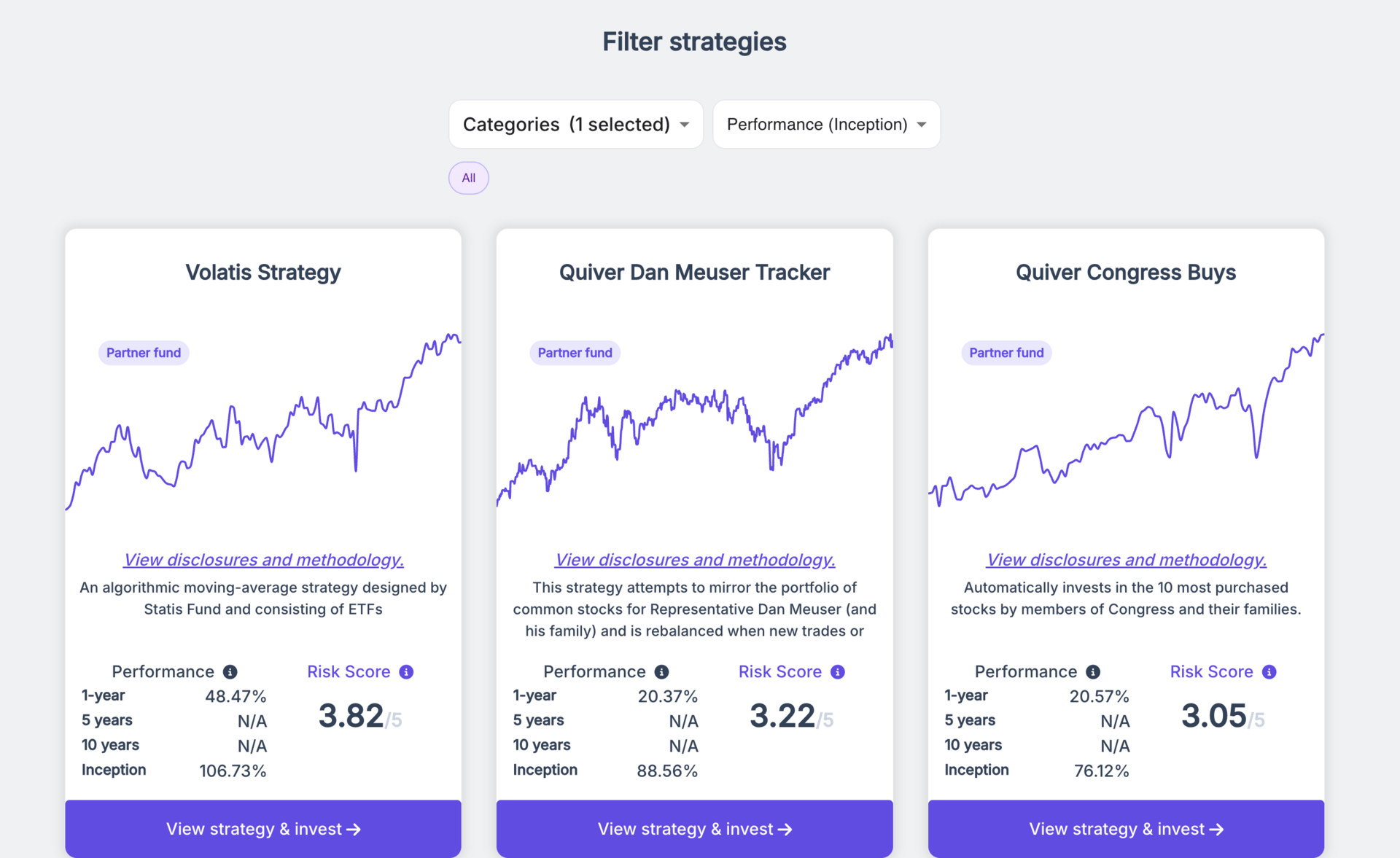

📈 Looking to copy trade?

If you're interested in automatically following insider trading strategies, check out the quantitative trading strategies available on Quantbase. They offer systematic approaches to insider trading signals that remove emotion from the equation.

👋 Closing Notes

This week revealed a market of pockets, not broad trends. Regional bank insiders see value the market doesn't. Technology hardware tied to AI infrastructure is attracting real capital. Biotech insiders are sellers. Consumer-facing companies? Crickets.

The concentration of buying in just two sectors—regional banks and one AI play—tells the real story. Insiders aren't broadcasting systematic optimism. They're making surgical bets where fundamentals diverge from price.

As November begins and earnings season wraps, watch for follow-through. If Eastern's Chair buys more, if Celestica's director keeps accumulating, or if biotech insiders suddenly emerge as buyers, those become confirmation signals. For now, the message is surgical: value exists, but it's specific, not systematic.

The smart money isn't chasing. It's buying what it knows is cheap.

Disclaimer: This newsletter is for informational purposes only and does not constitute investment advice. Insider transactions can occur for many reasons unrelated to company prospects, including personal financial planning, diversification, and tax management. Always conduct your own research and consult with a financial advisor before making investment decisions. Past performance does not guarantee future results.